15 December 2021, Munich – 2060 – By this time, China plans to be climate neutral.1 One step towards this goal is the dual control of energy consumption policy, that’s been renewed by the National Development and Reform Commission (NDRC) in 2021. The Chinese government ordered the suspension of production and limited electricity by high-energy consuming industries, which led to shutdowns and power cuts in several Chinese provinces.2 For example, in provinces such as Jiangsu, Yunnan and Zhejiang, power rationing was driven by the excessive implementation of the dual control policy, which saw local governments ordering factories to cut back operation in order for them to meet their dual targets on total energy consumption and energy intensity.* In other provinces such as Guangdong, Hunan and Anhui, factories were forced to operate in off-peak hours to prevent power shortages.3 The province Jiangsu, which together with Guangdong accounts for around 20 % of the country’s industrial capacity and where numerous pharmaceutical manufacturing sites for APIs, intermediates and solvents are located, exceeded both the target for total energy consumption as well as energy intensity.4 In September, the local authorities implemented special energy-saving supervision for enterprises that have an annual energy consumption equal to 50,000 tons of standard coal or more and larger manufacturers which surpassed the two targets for total energy consumption and energy intensity.

This resolution affected over 300 enterprises in Jiangsu, which effectively led to production shutdown for numerous chemical plants.5 Overall, there are around 20 provinces in China affected by that policy since August 2021. So with decreasing operating times (due to e.g. offpeak operation), cuts in production output as well as shutdowns becoming more frequent, supply chains for APIs and intermediates will likely be more tense in the near future.

The QYOBO platform – with its company profiles on API and intermediate manufacturers worldwide – now also provides deep insights into manufacturing locations and resulting supply chains. In early 2021, the platform will allow users to automatically assess their supply chain robustness for any product and provide a proactive supply risk summary. Based on a prototype of this functionality, we analysed and compared the data for two (randomly selected) APIs – gemcitabine and pantoprazole sodium. For each link of the supply chain, we assess the potential impact of the dual control policy in China.

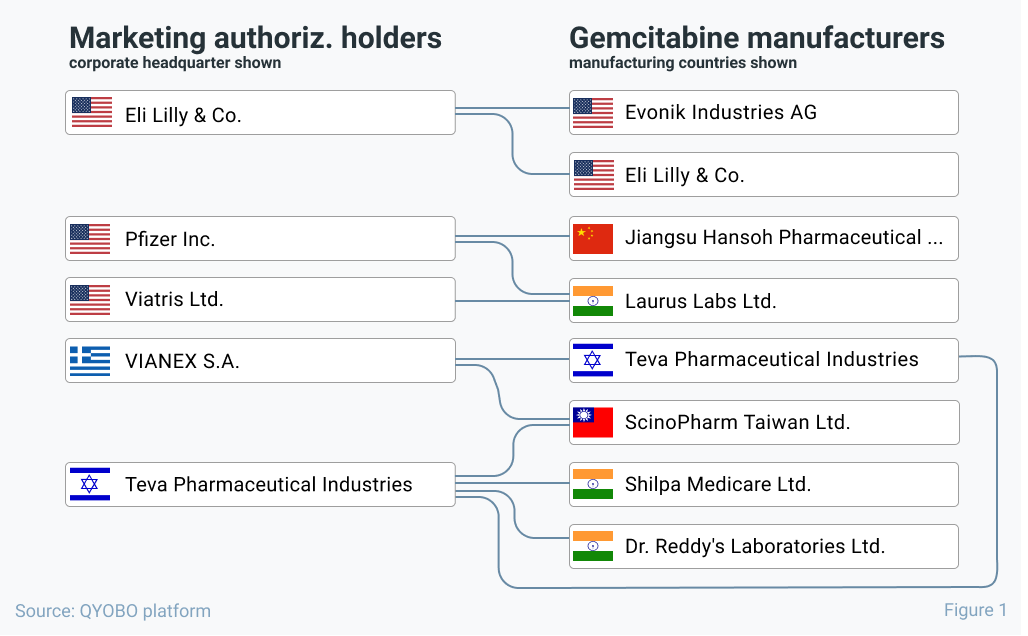

Where are MA holders sourcing from?

We start with the most downstream link of the supply chain – answering the question where Marketing authorization holders (“MA holders”) are sourcing their APIs. Based on the QYOBO platform, figure 1 shows the supply chain links between a handful of randomly selected MA holders for gemcitabine drugs and their respective API manufacturers. Based on the diverse API manufacturing footprint ranging from China, India, Israel, Taiwan to the USA, at first sight there is no indication of a risk exposure (e.g. to supply disruptions from curbed API manufacturing output) from the dual control policy in China. Compared to many other molecules, it is actually quite remarkable how most of these companies are doublesourced (or more) for this molecule.

A similar analysis for pantoprazole sodium** indicated similarly robust links between MA holders and API suppliers as for gemcitabine – hence no immediate supply chain risks from the dual control policy seems to be the case for either substance.

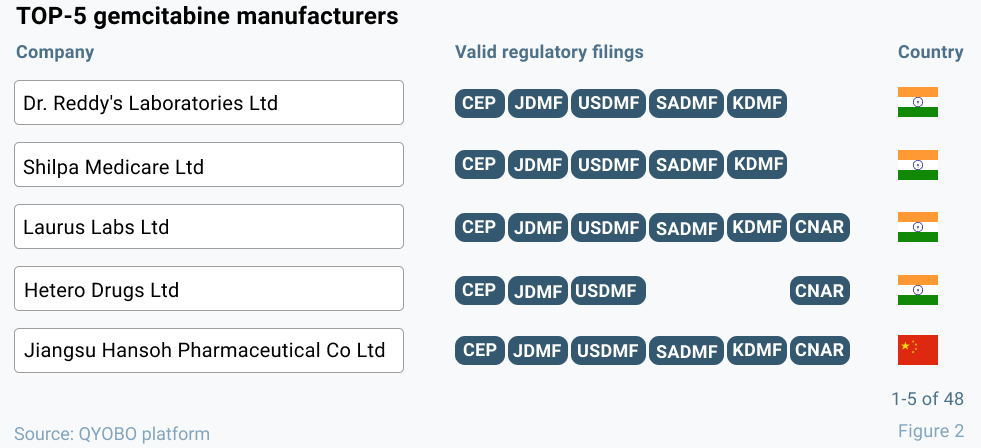

Where are API manufacturers located?

With its global supplier lists, the QYOBO platform provides an additional angle at global supply chains. For gemcitabine, our platform lists 48 suppliers (manufacturers and traders), thereof 33 manufacturers. The Top-5 manufacturers by size are shown in figure 2 respectively. This “bird-eye perspective” on the gemcitabine manufacturer landscape indicates that – with the exception of Jiangsu Hansoh Pharmaceutical Co., Ltd. – the most relevant API manufacturers are located outside of China and thus not directly affected by the dual control energy directive. Again, pantoprazole sodium, shows a similar picture with the vast majority of its manufacturers located in India and no large producers in China.

Where are intermediate manufacturers located?

Hence in the third and final step, we dig deeper into the footprint of Chinese intermediate manufacturers***, which – among others – supply much of the Indian pharmaceutical industry. From this analysis, it becomes much clearer that an indirect risk from the dual control policy is in fact the case. A pressing example for this is that Jiangsu Coben Pharmaceutical, one of the key gemcitabine intermediate producers – supplying Dr. Reddy’s, Hetero Drugs and Shilpa Medicare – is situated in the province Jiangsu which exceeded targets in both energy intensity and energy consumption levels (see Figure 3.2).

In contrast, the supply chain analysis of the second substance – pantoprazole sodium – demonstrated that most of the API intermediate suppliers are located in India****, providing hard evidence that dual control policy in China has no effect on the supply chain of pantoprazole sodium.

Overall, considering the close ties between Indian API manufacturers and Chinese intermediate manufacturers, an indirect impact via their upstream sources in China should be expected. However, there is no one-size-fits-all answer as the risk varies for each drug substance depending on its specific manufacturing footprint. For a deep-dive into the supply chain of a particular substance, reach out for a demo of the supply chain feature via sales@qyobo.com.

* the energy use per unit of GDP (gross domestic product)

** which was also analyzed using the QYOBO platform but not visualized in this article for the sake of brevity

*** concentrating on the two gemcitabine intermediates 2-deoxy-2,2-difluoro-d-erythro-ribofuranose- 3,5-dibenzoate 1-methanesulfonate and 2-deoxy-2,2-difluoro-d-erythro-pentafuranous-1-ulose- 3,5-dibenzoate – see figure 3.2

**** specifically for the intermediate 2-Chloromethyl-3,4-dimethoxypyridine hydrochloride there are e.g. Nifty Labs, Aastrid International, R.P. Industries and many more

Glossary

![]() Active Pharmaceutical Ingredient

Active Pharmaceutical Ingredient

![]() Marketing authorization

Marketing authorization

![]() Certificate of Suitability to the monographs of the European Pharmacopoeia

Certificate of Suitability to the monographs of the European Pharmacopoeia

![]() Japanese Drug Master File

Japanese Drug Master File

![]() United States Drug Master File

United States Drug Master File

![]() Received Drug Master Files for Saudi Arabia

Received Drug Master Files for Saudi Arabia

![]() Korean Drug Master File

Korean Drug Master File

![]() Chinese API Registration

Chinese API Registration

About QYOBO GmbH

QYOBO’s mission is to improve access to essential medication for everyone by contributing to a more transparent, efficient and robust supply of pharmaceutical and chemical raw materials.

For this purpose, we’ve developed the QYOBO market analytics platform for APIs, intermediates and chemicals. From millions of trade, regulatory and financial datasets scattered around the world, our big data algorithms derive unique, actionable insights on market prices and trends, suggest suitable partners for your business and automate data-heavy workflows in procurement, supply chain and business development.

Founded in June 2019 and based in Munich, our company is pursuing its mission collaboratively with its international clients and has been recognized with numerous awards including the BASF market challenge and the Digital Innovation award 2020 by the German Federal Ministry for Economic Affairs & Energy (BMWi).

For further information please contact:

Ms. Thuy Linh Nguyen, Corporate Communications

communication@qyobo.com

www.qyobo.com

Disclaimer: The information in this article is not intended to be used for medication purposes. Please do not self-medicate and consult a physician/doctor for any questions with regard to your personal medical needs. This assessment has been prepared adhering to the highest quality standards based on a variety of external data sources (see sources) with the purpose of making distributed information accessible to a broader audience. The information contained in this document is provided on an “as is” basis and QYOBO GmbH assumes no responsibility or liability for the completeness, accuracy, usefulness or timeliness of the information provided. This article contains links to external websites operated by third parties upon which QYOBO GmbH has no influence. QYOBO GmbH does not assume any guarantee or liability for third party content.

¹ BBC, 29 October 2021.

² MINNEWS, 26 October 2021.

Will “Energy Consumption Dual Control” continue to increase in October?

³ Carbon Brief, 30 September 2021.

China Briefing, 30 September 2021: Widespread power cuts; New orders on ‘dual control’; Emissions peak likely ‘before 2028’.

4 S&P Global, 29 September 2021.

ANALYSIS: China’s energy intensity caps poorly timed amid ongoing fuel shortages

5 ECHEMI, 18 September 2021.

Dual Control’ in a major chemical province! Raw materials skyrocket! The supply is in a hurry!