27 April 2023, Munich – Impetiously growing inflation was a critical issue for the pharmaceutical industry in 2022. Although inflation is decreasing in many parts of the world in 2023, some industry leaders are setting the expectation that high prices are here to stay 1 2 3. Using the QYOBO platform, we conducted our own analysis of current price trends. Based on big data (pulling from over 65 million trade datasets around the globe), we examined price dynamics for the 300 most popular APIs of our clients and aggregated this data into the QYOBO 300 API price index. This index indicates how prices change from one year to the other. It is weighted by trade volume, thus molecules with greater (economic) importance, have a larger impact.

An earlier analysis of this index in the last year highlighted that although the index had steadily increased over the past years, API prices increased only moderately in 2022 compared to overall inflation. Many well-known molecules such as Paracetamol, Metformin, Rosuvastatin, or Heparin had increased substantially in 2022, leading many industry experts to believe this was a broader pattern that also extended to the less well-known molecules. Our analysis last year surfaced that this was, in fact, not the case, as the majority of molecules decreased in price or remained at a stable price level.

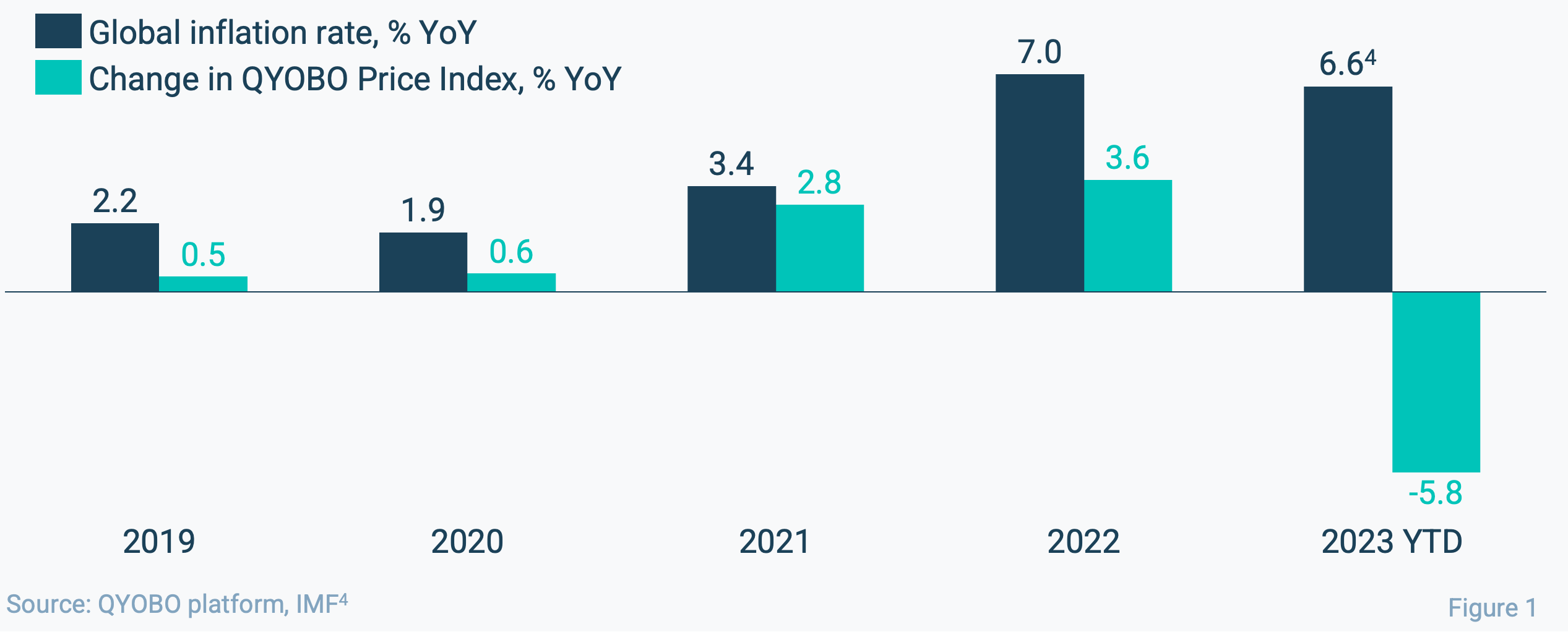

Based on the constantly updating market insights on the QYOBO platform, we refreshed our analysis several times last year. The first analysis based on Q1 data showed an overall price increase of 5.2% compared to 2021. The second quarter stood at a similar level with 5.1%. The first signs of an accelerating price decrease were obvious in Q3 as the price change fell to 4.8%. For the entire year 2022, the index now shows a price increase of only 3.6% vs. 2021, indicating a very significant price decline in the last quarter 2022.

This dynamic will continue in 2023. Compared to the average prices in 2022, prices for the first quarter of 2023 are almost 6% lower (see Figure 1).

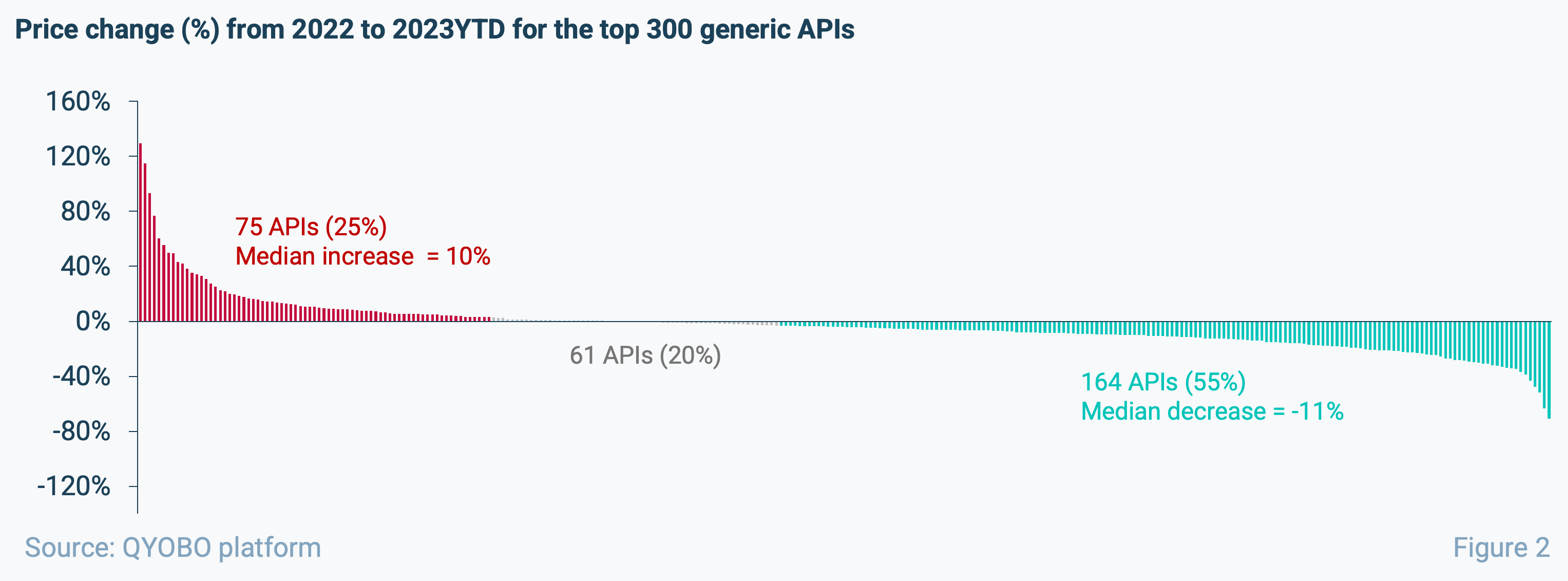

As shown in Figure 2, the vast majority of APIs (55%) are experiencing a price decrease. In contrast, only a quarter (25%) became more expensive.

The information on KSM prices and how they affect current and future API prices are complemented by the AI price forecast on the QYOBO platform (see the right side of the charts in Figure 4). Based on our proprietary (and continuously self-validating) forecasting model, the forecast indicates how prices are expected to develop in the coming three months.

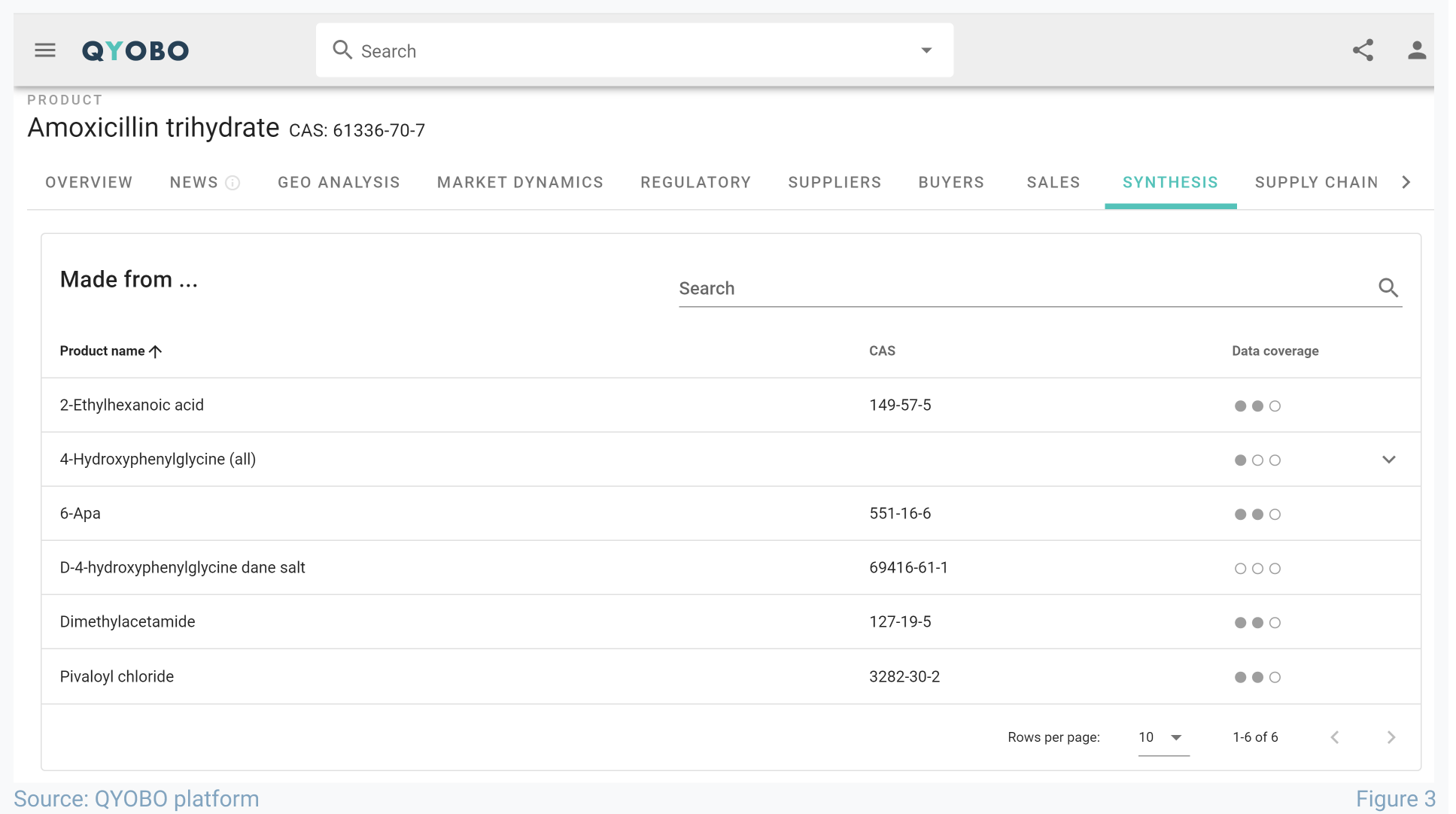

Combining the AI forecast with the ability to compare API and KSM prices, the QYOBO platform makes it possible to anticipate future prices both in the short and long term (click here for a recent client case study). For Amoxicillin trihydrate, the API price forecast indicates a fairly stable level in the next three months. The KSM, 6-APA, however, is expected to increase slightly in the same timeframe, hinting that a marginally higher API price in the short term is still in the cards. Metformin hydrochloride shows a similar picture. Here, however, stable or falling API prices can be expected over a longer timeframe as the KSM, Cyanoguanidine, has fallen much more rapidly in the past quarters, whereas the API price has not moved so significantly and thus has more potential for further decreases.

While inflation is still on everyone’s mind when going grocery shopping, a data-driven perspective on 2023 API prices highlights substantial price decreases for the vast majority of APIs. For further details, feel free to contact our sales team anytime.

Approach

To calculate the QYOBO API price index “Total trade weighting” method was applied which combines the information from the 300 Top APIs – the most subscribed products by QYOBO clients – to a powerful industry metric.

The weight for a substance (i) in any given year (y) in the index is based on the total trade (as a product of price Py,i and the volume Vy,i) for the respective year. Po,i is the average yearly price of the base index year (previous to a given year). This approach limits the influence from substances with smaller overall trade size compared to substances with larger trade sizes (such as Ibuprofen, Heparin or Paracetamol) .

Glossary

Active pharmaceutical ingredient

Key starting material

Year-to-date

About QYOBO GmbH

QYOBO’s mission is to improve access to essential medication for everyone by contributing to a more transparent, efficient and robust supply of pharmaceutical and chemical raw materials.

For this purpose, we’ve developed the QYOBO market analytics platform for APIs, intermediates and chemicals. From millions of trade, regulatory and financial datasets scattered around the world, our big data algorithms derive unique, actionable insights on market prices and trends, suggest suitable partners for your business and automate data-heavy workflows in procurement, supply chain and business development.

Founded in June 2019 and based in Munich, our company is pursuing its mission collaboratively with its international clients and has been recognized with numerous awards including the BASF market challenge and the Digital Innovation award 2020 by the German Federal Ministry for Economic Affairs & Energy (BMWi).

Disclaimer:

The information in this article is not intended to be used for medication purposes. Please do not self-medicate and consult a physician/doctor for any questions with regard to your personal medical needs. This assessment has been prepared adhering to the highest quality standards based on a variety of external data sources (see sources) with the purpose of making distributed information accessible to a broader audience. The information contained in this document is provided on an “as is” basis and QYOBO GmbH assumes no responsibility or liability for the completeness, accuracy, usefulness or timeliness of the information provided. This article contains links to external websites operated by third parties upon which QYOBO GmbH has no influence. QYOBO GmbH does not assume any guarantee or liability for third party content.

For further information please contact:

Ms. Iuliia Voronina,

Corporate Communications,

QYOBO GmbH

1 Pharmaceutical Technology, 16.01.23

Inflationary storm clouds will continue

to buffet global pharma industry in 2023

3 The Economic Times, 31.01.2023

Prices can’t go down further in

APIs or it will turn unviable for new

entrants: Laurus Labs CEO

4 International Monetary Fund