20 October 2021, Munich – Whether it’s fever, pain or inflammation – For all these complaints ibuprofen is a first choice medication. Therefore it’s no surprise that the nonsteroidal anti-inflammatory drug (NSAID) has been on the World Health Organization’s (WHO) list of essential medicines since 19771 and is a commonly used drug within the population.2

The global demand for ibuprofen is estimated to be in the range of 35-40,000 tons/year with the vast majority being produced by six companies in China, India and the USA3,4,5: BASF Corporation (USA), Hubei Biocause (China), IOL Chemicals and Pharmaceuticals (India), Shandong Xinhua (China), SI Group (USA) and Solara Active Pharma Sciences (India).6

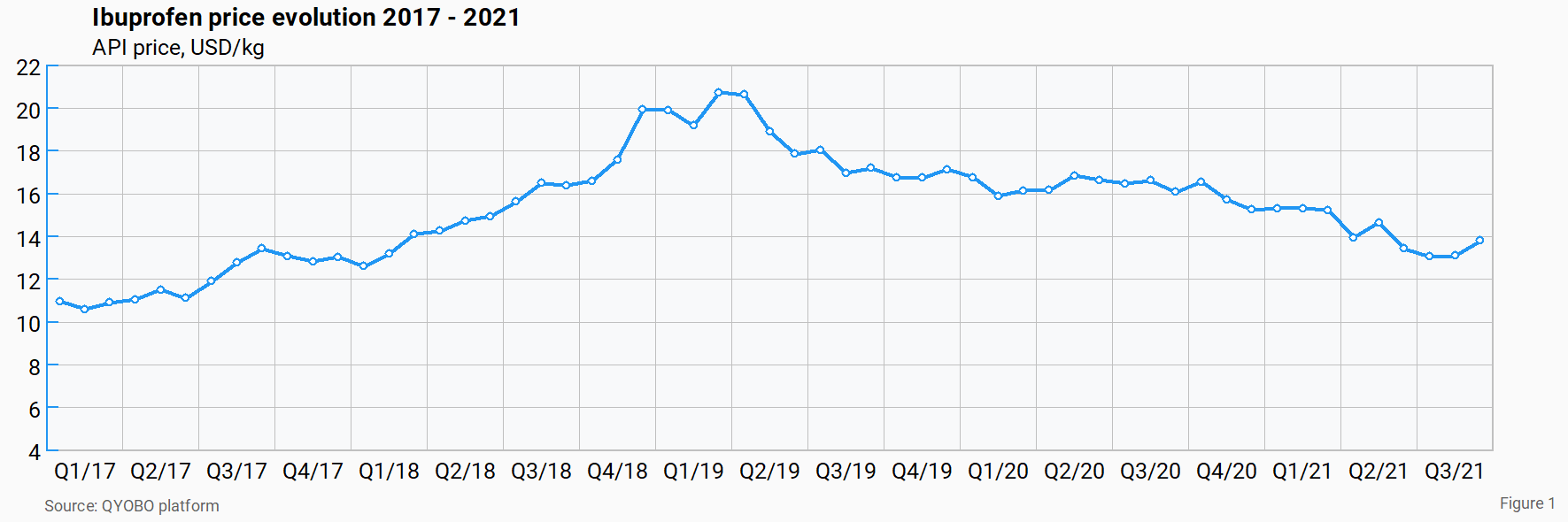

Despite the maturity of the API, the ibuprofen market has been quite dynamic over the past couple of years. At the beginning of 2017, prices were increasing due to growing demand. A year later, in June 2018, the world’s largest chemical manufacturer BASF had to temporarily shut down its manufacturing site in Bishop, Texas due to technical problems. The plant in Bishop reportedly has a capacity of 5,000 tonnes per year, meaning around 15% of the global demand can be covered by the US subsidiary of the German chemical group.7

The ibuprofen shortfall resulting from the shutdown led to an additional price increase over the next 9 months until a peak of 20.7 USD/kg was reached in March 2019.

Back in 2017, BASF had announced plans to invest around 200 million euros (approx. 235 million US dollars) into a new ibuprofen manufacturing site at its German headquarter in Ludwigshafen on top of expanding the production capacity in Bishop. This would have made BASF the first company to produce ibuprofen at more than one plant worldwide8 but not the sole company with ambitious expansion plans. For instance, in 2018 IOL planned to significantly increase their ibuprofen manufacturing capacity over a span of two years from 7,500 to 12,000 tonnes per annum (TPA).9,10 In the same year, the SI Group also extended its manufacturing capacity in Orangeburg, South Carolina, by 10% and announced to add another 25% more in capacity in the future to keep up with growing demand due to an increasingly older population. “Ibuprofen demand is growing at a 4% CAGR, largely driven by the growing middle class and aging population demographics […] Only six suppliers represent over 90% of the nameplate industry capacity. […] Without additional capacity, it is projected that the industry could go into a deficit as early as 2020. The industry requires new investment immediately”, the SI Group affirmed in 2018.11

With several players increasing capacity and others planning to do so, market prices took a sharp turn after the peak in March 2019 decreasing roughly over a two and a half year period to 13.1 USD/kg in July 2021. The new market dynamics turned out to have a profound impact on the market landscape and ongoing investment plans.

One example for this is BASF, which – while continuing to increase its output in the Bishop plant by the end of 2020 – seems to have put plans to build a second ibuprofen manufacturing site in Ludwigshafen, Germany on ice (The investment plans “Construction: production plant for ibuprofen 2022” were last mentioned in the 2018 annual report and are no longer mentioned in the 2019/2020 annual reports.)12,13,14

A second example is Granules India, which in February 2020 divested its shares in the 50:50 joint venture with Hubei Biocause which has 4,800 TPA installed ibuprofen capacity in central China. Among other things, the company leadership cited a capacity surplus and falling ibuprofen prices for the decision (When asked whether Granules India will produce ibuprofen in India following the divestiture, Managing Director Krishna Prasad Chigurupati answered “we have no plans to start manufacturing ibuprofen because there is already a surplus capacity that has come up.”)15

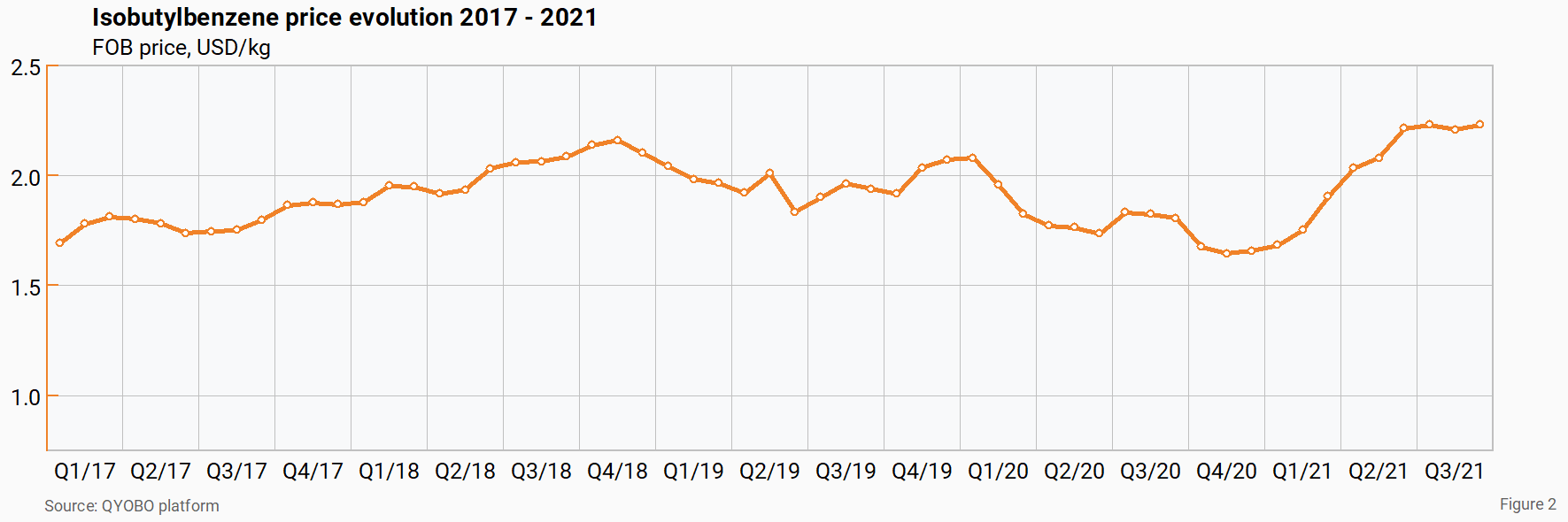

Taking a closer look at the ibuprofen price chart in figure 1, the data reveals that prices have been stabilizing over the past 3 months at around 13 USD/kg. It is interesting to note that this correlates with an all-time price peak of isobutylbenzene (IBB), a key intermediate in the manufacturing of ibuprofen (see figure 2). It thus appears that decreasing ibuprofen prices combined with increasing IBB prices have put a stop to the downward trend for ibuprofen.

With many of the aforementioned capacity expansions now realized and serving the market, stabilizing prices are a strong indicator that the market is approaching an equilibrium between supply and demand. However, due to the continuously increasing demand for ibuprofen, prices are highly likely to not only stabilize, but to rebound and trend upwards again in the coming months. This trend is likely to endure for a longer time period until market prices yet again provide a favourable foundation for substantial capacity expansion.

Glossary

![]() Active Pharmaceutical Ingredient

Active Pharmaceutical Ingredient

About QYOBO GmbH

QYOBO’s mission is to improve access to essential medication for everyone by contributing to a more transparent, efficient and robust supply of pharmaceutical and chemical raw materials.

For this purpose, we’ve developed the QYOBO market analytics platform for APIs, intermediates and chemicals. From millions of trade, regulatory and financial datasets scattered around the world, our big data algorithms derive unique, actionable insights on market prices and trends, suggest suitable partners for your business and automate data-heavy workflows in procurement, supply chain and business development.

Founded in June 2019 and based in Munich, our company is pursuing its mission collaboratively with its international clients and has been recognized with numerous awards including the BASF market challenge and the Digital Innovation award 2020 by the German Federal Ministry for Economic Affairs & Energy (BMWi).

For further information please contact:

Ms. Thuy Linh Nguyen, Corporate Communications

communication@qyobo.com

www.qyobo.com

Disclaimer: The information in this article is not intended to be used for medication purposes. Please do not self-medicate and consult a physician/doctor for any questions with regard to your personal medical needs. This assessment has been prepared adhering to the highest quality standards based on a variety of external data sources (see sources) with the purpose of making distributed information accessible to a broader audience. The information contained in this document is provided on an “as is” basis and QYOBO GmbH assumes no responsibility or liability for the completeness, accuracy, usefulness or timeliness of the information provided. This article contains links to external websites operated by third parties upon which QYOBO GmbH has no influence. QYOBO GmbH does not assume any guarantee or liability for third party content.

¹ World Health Organization.

Ibuprofen.

² NCBI, 30 May 2021.

Ibuprofen.

³ PR Newswire, 21 April 2021.

Global Ibuprofen Market Size to Grow at 2-3 Percent CAGR by 2023, Says Beroe Inc.

4 Business Standard, 22 August 2018.

Ibuprofen API prices jump 30% in international market due to supply crunch.

5 PR Newswire, 24 September 2019.

Global Ibuprofen Market Size to Reach 45,233 MT by 2022, Says Beroe Inc.

6 APOTHEKE ADHOC, 01 March 2019.

Ibuprofen: BASF fährt langsam wieder hoch.

7 Reuters, 27 June 2018.

BASF shuts ibuprofen production at U.S. plant due to technical problem.

8 BASF, 28 June 2017.

BASF plans significant investment in ibuprofen capacities in Germany and North America.

9 Future Market Insights, 10 April 2020.

Ibuprofen API Market to Stumble Due to Delayed Production and Consequent Supply Shortages of Raw Materials, Says a New FMI Report.

10 Capitalmind, 15 January 2019.

Outlier in Focus: A Quick View of IOL Chemicals and Pharmaceuticals.

11 FiercePharma, 13 August 2018.

Aging population prompts SI Group to again expand ibuprofen production at U.S. plant.

12 BASF, 2018.

BASF Report 2018.

13 BASF, 2019.

BASF Report 2019.

14 BASF, 2020.

BASF Report 2020.

15 Granules India, 23 October 2019.

Granules India Limited Q2 FY ‘20 Earnings Conference Call.