04 November 2020, Munich – Macrolides and cephalosporins are some of the most commonly used antibiotics. During the CoViD‐19 crisis, several of these APIs like azithromycin and cefuroxime turned out to be effective in the treatment of patients infected with CoViD‐19. This consideration had a profound impact on prices and trends, with some APIs seeing an increase of more than 50%.

The third QYOBO article on API market dynamics continues with macrolides and cephalosporins (β-lactam). These two groups of antibiotics are primarily used to treat bacterial infections.

Based on their anti-inflammatory and immunomodulatory effects*, macrolides like clarithromycin, azithromycin or erythromycin have been proposed as treatment against CoViD‐19, now categorized as a viral respiratory infection.¹ According to the Infectious Diseases Society of America (IDSA) and the American Thoracic Society (ATS), relevant bacterial pathogens in patients with CoViD‐19 and pneumonia are the similar as in patients with community-acquired pneumonia (CAP). Therefore, the same treatment has been recommended, combining a macrolide like azithromycin and a β-lactam such as ceftriaxone.² ³

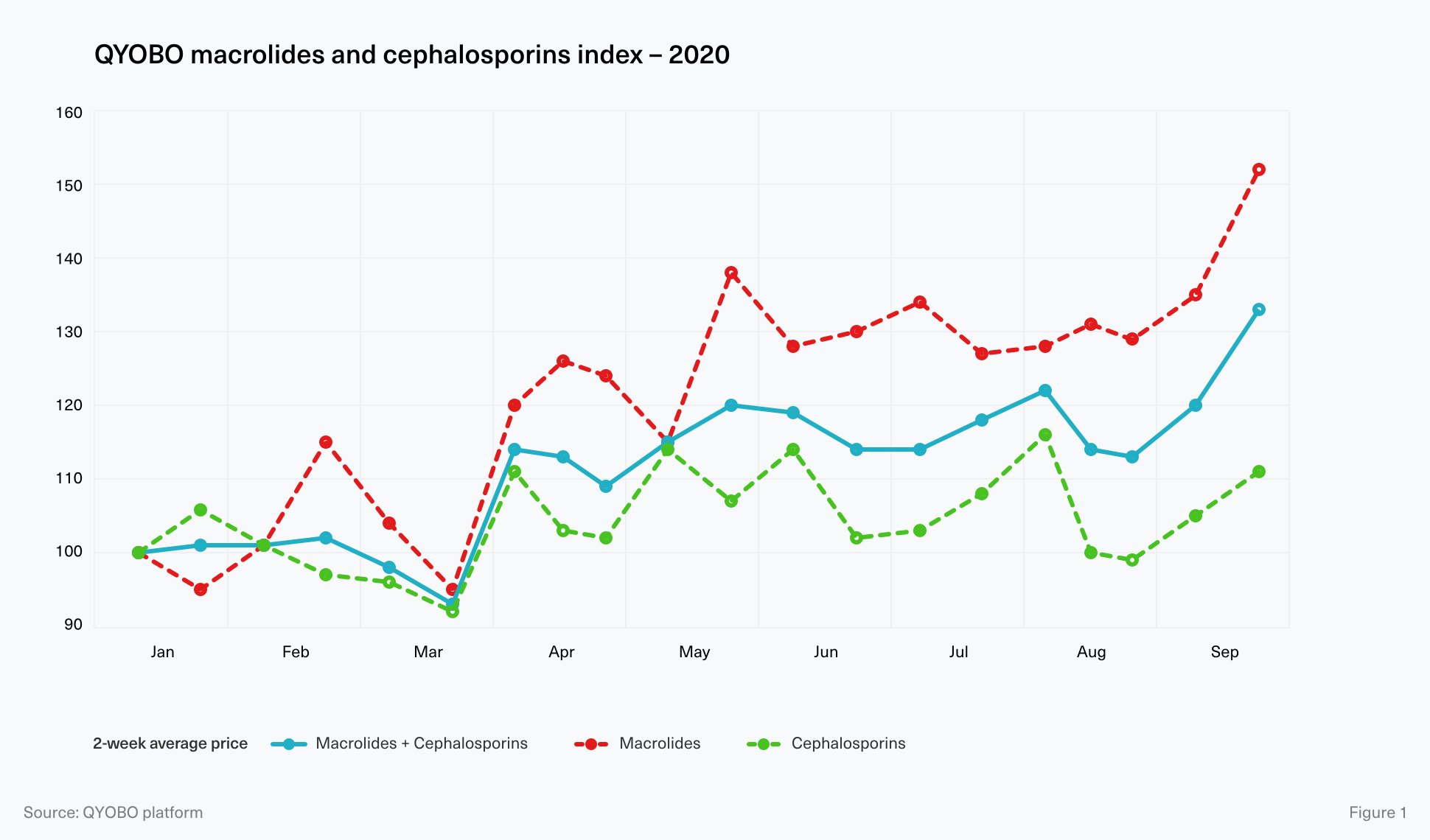

Summarizing the market development in 2020 across the two substance groups, QYOBO compiled an aggregated index for macrolides and cephalosporins (86 “macrolides” and “cephalosporins” substances and their salts), shown in figure 1 ![]() .

.

In the 3rst two months of 2020 the index remained stable. This was followed by a 7 point decrease in March (compared to its January level). However, as the corona crisis gained momentum, in early-April the index increased rapidly by around 20 points and remained at a relatively high level ever since. Just a few weeks ago – in sync with the “second waves” of covid-19 infections – the index reached its maximum of 133 points in September 2020 (compared to 100 base points in January 2020).

To highlight how each of the two substance groups performed throughout the year, two sub-indexes – one for cephalosporins ![]() and one for macrolides

and one for macrolides ![]() are shown in figure 1.

are shown in figure 1.

Cephalosporins experienced a slight 6 points increase in January after which prices decreased until the end of March, followed by the most significant increase this year in April. To date, prices continue to fluctuate between 99 to 116 points, thus remaining at an overall lower level than the aggregated index.

Market dynamics for macrolides were even more dynamic than for cephalosporins with prices currently 50 points above January 2020 levels. The strongest increase by about 60 points occurred from 95 points in March to 152 points in September 2020.

In the early stage of the CoViD‐19 crisis, azithromycin in combination with hydroxychloroquine was considered as a potential treatment against the novel virus. Though randomised trials found no evidence that patients infected with CoViD‐19 benefit from treatments with hydroxychloroquine at any disease stage, some studies came to a positive conclusion regarding azithromycin being effective for patients with CoViD‐19 symptoms. The API is strongly available and could be easily scaled up as a first-line treatment for patients with CoViD‐19.⁴ But after the API was strongly recommended to treat infected patients, numbers of prescriptions spiked in the US resulting in shortages of the finished azithromycin drug which also affected the API market (compare figure 2). ⁵

The global average API price for azithromycin in 2020 increased significantly from 93 USD/kg in January to 155 USD/kg in April (+67%). The increase was followed by fluctuations between 126 and 155 USD/kg after which prices continued to increase in June-July 2020. Apart from a slight drop in August to 137 USD/kg, prices remained at a comparably high level with an average price of 148 USD/kg in September 2020. The price dynamics this year affected all qualities and grades, for example USP/EP grade stood at 95 USD/kg in January (vs. 93 USD/kg for unregulated** grade) and increased to 148 USD/kg in September (vs. 147 USD/kg for unregulated grade).

Another macrolide that has been considered as a potential treatment for patients with CoViD‐19 is erythromycin. The medication is considered a promising treatment against CoViD‐19 for it’s anti-bacterial and anti-inflammatory effects. Because of these properties the Department of Internal Medicine, JCHO Hokkaido Hospital, Sapporo and the Department of Respiratory Medicine, Faculty of Medicine and Graduate School of Medicine, Hokkaido University, Sapporo recommend the drug not only for the treatment against CoViD‐19 symptoms but also as a preventive measure. ⁶

During January until early-May 2020 prices for erythromycin ranged between 45 USD/kg and 55 USD/kg. At the end of May the global average price reached its YTD high of 62 USD/kg – driven by API exports from Spain and Italy to India which had been facing a rapid increase of CoViD‐19 cases at the time. In June the market situation appeared to relax as prices returned to February levels. However until the end of September 2020, prices had increased to 58-60 USD/kg (15% YTD increase).

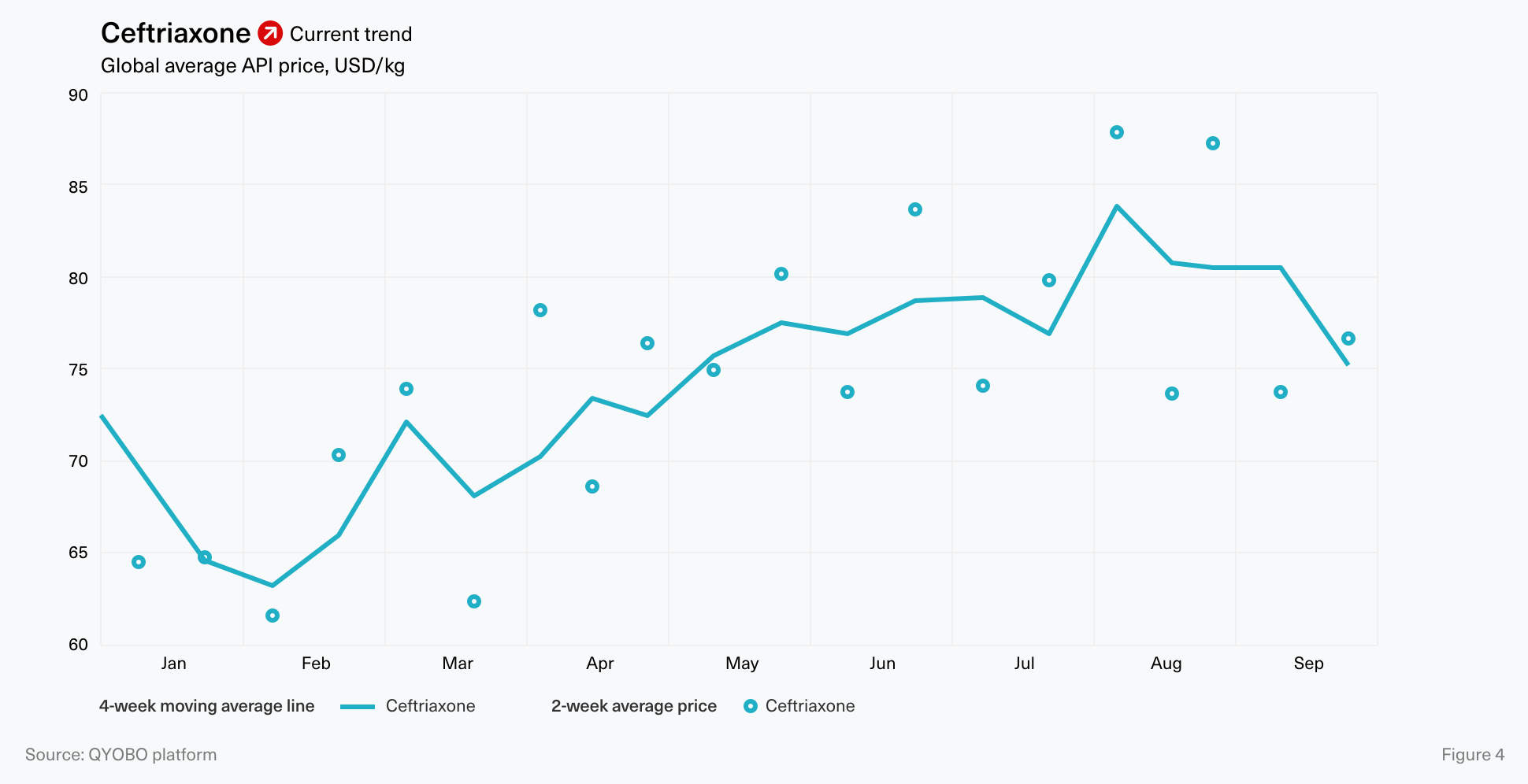

Cephalosporins are a large group of β-lactam antibiotics used to treat infectious diseases. They are the most commonly prescribed drug class worldwide with various clinical indications CAP. ⁷ Patients with pneumonia are usually put on treatments including ceftriaxone. ⁸

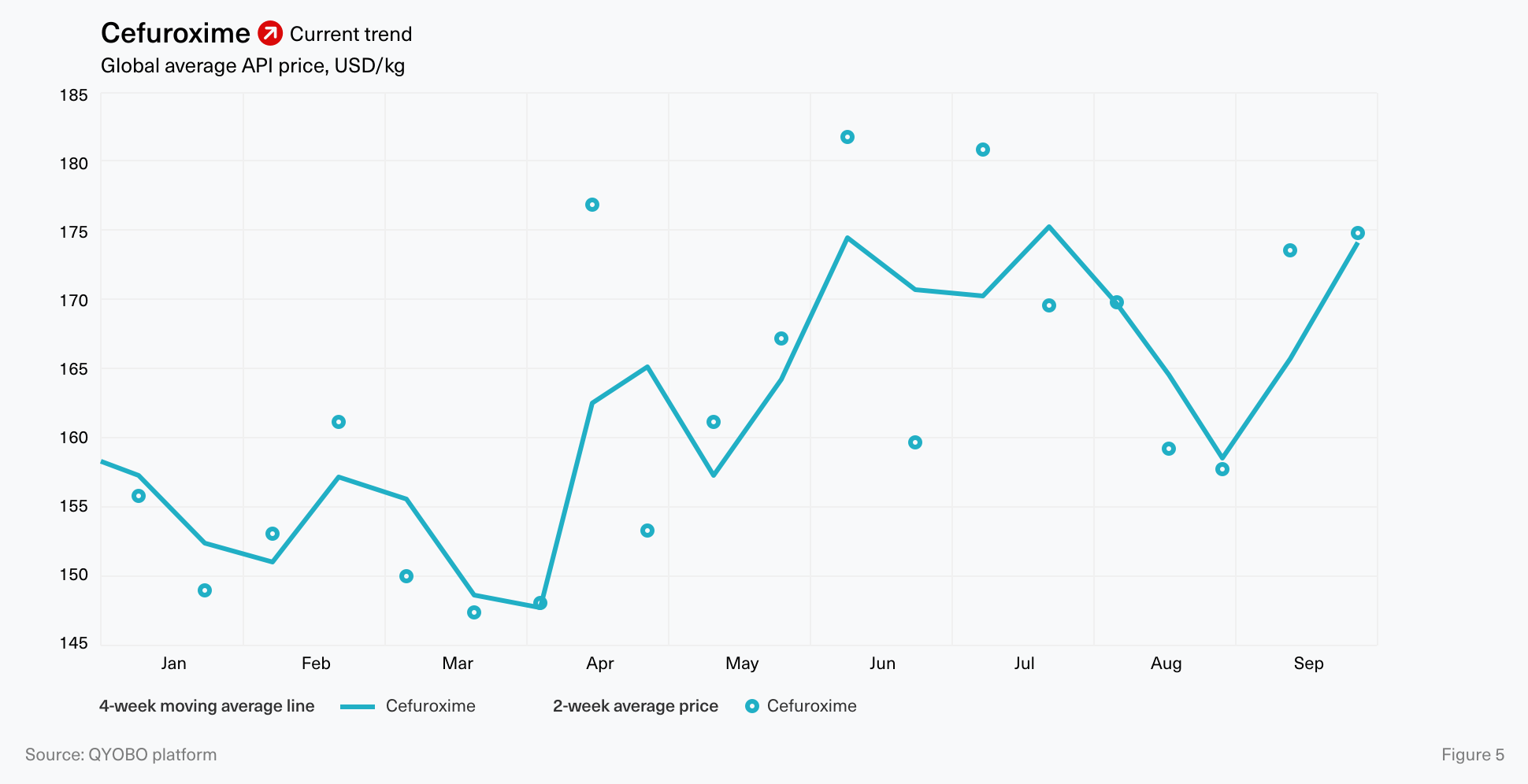

Another cephalosporin considered to be effective in CoViD‐19 patients is cefuroxime which targeted three SARS-CoV-2 proteins in experiments. The API is considered to be safe based on its long history of usage and tracking, making it a reliable option for further studies in the treatment of CoViD‐19 infections. ⁹

Like many other anti-infectives, e.g. amoxicillin or benzylpenicillins, prices for cefuroxime continued their price decline from 2019 onwards into the first quarter of 2020. In April prices started to rise, reaching an all-year high of 182 USD/kg in June (+17% compared to January). Apart from a slight dip in August, prices remained at comparably high levels of 170 to 180 USD/kg ever since.

7-aminocephalosporanic acid (7-ACA) is a key intermediate in the production of semisynthetic cephalosporin antibiotics such as ceftriaxone or cefuroxime. ¹⁰

Prices for 7-ACA were decreasing from 49 USD/kg in January 2020 to 44 USD/kg in April 2020. However, in the beginning of May the price increased rapidly to 52 USD/kg. Starting from June 2020, when the year-maximum of 57 USD/kg was reached, prices stayed at a relatively high level of more than 55 USD/kg.

Driven by the current corona crisis, QYOBO has started to analyze key starting materials (KSMs) and provides a detailed overview on the global market and supplier situation in the QYOBO platform. Further market trends on several intermediates and KSMs will be featured in later articles.

* Immunomodulators are medications used to help regulate or normalize the immune system.

** Unregulated = trades without speci!c quality tags for pharmacopeias such as British Pharmacopeia (BP), EP, USP, JP, etc.

Approach

Price curves

Prices are weighted average prices (weighted by trade volume) for each month. Prices reflect FOB prices (free on board), excluding freight or insurance cost. The price curves for a given substance include data points for all known salts for this substance, e.g. quinapril base, quinapril hydrochloride for “Azithromycin“.

Source

This report has been generated leveraging the QYOBO market analytics platform. The big-data powered platform combines trade data, regulatory information and further enriching (nancial data on the market from a large variety of distributed databases around the globe. For its API benchmarks, QYOBO processes over 20 million trade dataset from 18 countries (e.g. Argentina, Chile, China (partially), India, Kenya, Mexico, Russia, the USA, Vietnam) in 8 languages. The time frame assessed for this analysis was January through early July 2020.

Index calculation

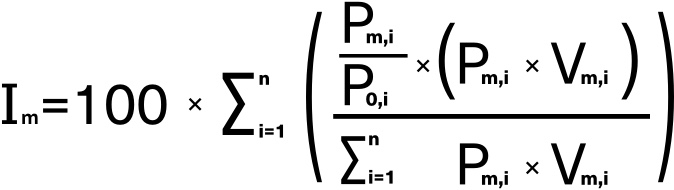

To provide an accurate representation of the group, the weighting method for the index is “Total trade weighting” the ARBs and ACE inhibitors subgroups of cardiovascular system group – according to WHO Anatomical Therapeutic Chemical Classification System. The weight for a substance (i) in any given month (m) in the index is based on the total trade (as a product of price pm,i and the volume vm,i) for the respective month. p0,i is the average monthly price of the base index month, January 2020. This approach limits the influence from substances with smaller overall trade size compared to substances with larger trade sizes.

Index formula:

Glossary

![]() Active pharmaceutical ingredient

Active pharmaceutical ingredient

![]() First half of the year

First half of the year

![]() Year to date

Year to date

About QYOBO GmbH

QYOBO GmbH is a Munich-based tech company providing actionable market insights on the API, excipient and chemical markets. The company has developed proprietary big data algorithms to process and enrich data from a large variety of distributed data sources. Leveraging this expertise, QYOBO provides its clients with a one-stop solution to benchmark prices, analyze trends, identify relevant trading partners and streamline adjacent sales and procurement workflows.

QYOBO’s clients include API manufacturers and pharmaceutical companies in Europe and beyond. In 2019, QYOBO won BASF’s Digital Market Challenge against over 100 startups worldwide. The company has recently been recognized as a “Digital Innovation” by the German Federal Ministry of Economic Affairs and Energy (BMWi) and is one of the 10 most innovative startups according to WECONOMY/Handelsblatt.

For further information please contact:

Ms. Thuy Linh Nguyen, Corporate Communications

communication@qyobo.com

www.qyobo.com

Disclaimer: The information in this article is not intended to be used for medication purposes. Please do not self-medicate and consult a physician/doctor for any questions with regard to your personal medical needs. This assessment has been prepared adhering to the highest quality standards based on a variety of external data sources (see sources) with the purpose of making distributed information accessible to a broader audience. The information contained in this document is provided on an “as is” basis and QYOBO GmbH assumes no responsibility or liability for the completeness, accuracy, usefulness or timeliness of the information provided. This article contains links to external websites operated by third parties upon which QYOBO GmbH has no influence. QYOBO GmbH does not assume any guarantee or liability for third party content.

¹ International journal of antimicrobial agents, 10 June 2020.

Macrolides and viral infections: focus on azithromycin in CoViD-19 pathology.

⁵ ScienceMag, 16 April 2020.

Antibiotic treatment for CoViD-19 complications could fuel resistant bacteria.

⁹ Journal of biomolecular structure & dynamics, 13 June 2020.

Repurposing cefuroxime for treatment of COVID-19: a scoping review of in silico studies.

² Annals of Internal Medicine, 18 August 2020.

Treatment of Community-Acquired Pneumonia During the Coronavirus Disease 2019 (COVID-19) Pandemic.

⁶ Bioscience trends, 5 April 2020.

Macrolide treatment for CoViD-19: Will this be the way forward?

¹⁰ Studia Universitatis Babes-Bolyai, Chemia, 2019.

7-Aminocephalosporanic Acid-Production And Separation.

³ American Journal of Respiratory and Critical Medicine, 1 October 2019.

Diagnosis and Treatment of Adults with Community-acquired Pneumonia. An Official Clinical Practice Guideline of the American Thoracic Society and Infectious Diseases Society of America.

⁷ StatPearls [Internet], 9 September 2020.

Beta lactam antibiotics.