Ireland in Focus: 15% U.S. Tariffs Challenge Pharma Exports

Ireland has become the backbone of transatlantic medicine flows. The 15% U.S. tariff on EU pharmaceutical imports (White House Fact Sheet, July 28, 2025), effective August, ends decades of tariff-free medicine trade and adds new uncertainty. With Ireland producing APIs and finished drugs across immunology, oncology, and GLP-1 therapies, the stakes are high for U.S. patients and global supply chains.

Introduction

The United States relies heavily on Ireland for critical medicines and production inputs. Over the past two decades, a combination of factors including favorable tax policy (Tax Foundation Europe, January 14, 2025) has attracted nearly all of the world’s top pharmaceutical companies to set up large-scale operations in this island nation.

The country’s manufacturing footprint spans the full spectrum of the value chain, from organic chemicals (including active pharmaceutical ingredients or APIs, intermediates, and excipients) to finished dosage forms (FDF).

Ireland’s sites are deeply integrated into global supply lines for critical therapeutic categories, such as oncology, immunology, diabetes and metabolic disorders, rare diseases, and vaccines, henceforth, making it not only the manufacturing hub of the EU but also a linchpin in transatlantic medicine flows.

US Imports of Finished Drugs and Organic Chemicals from Ireland

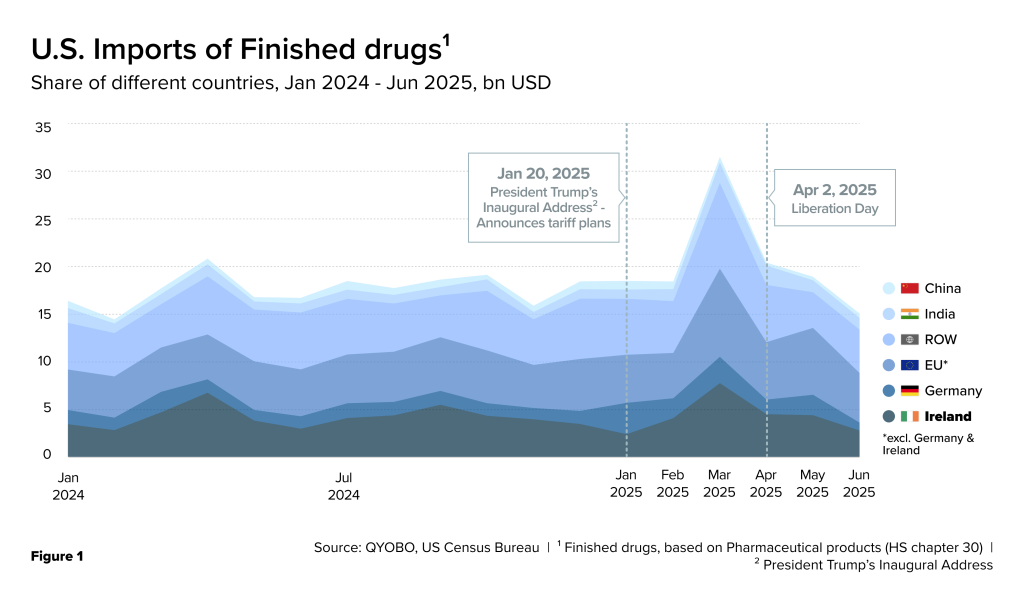

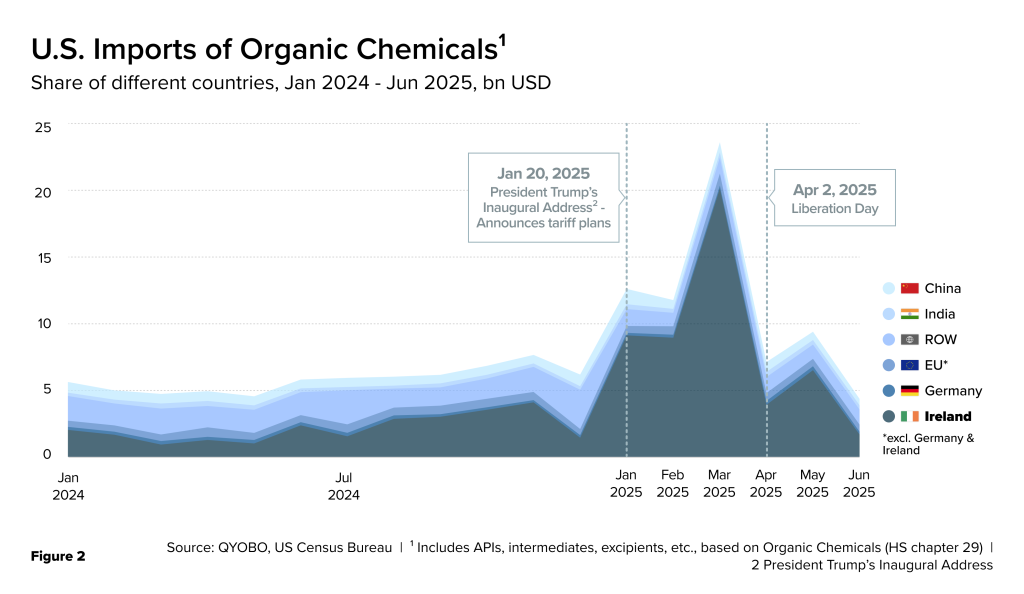

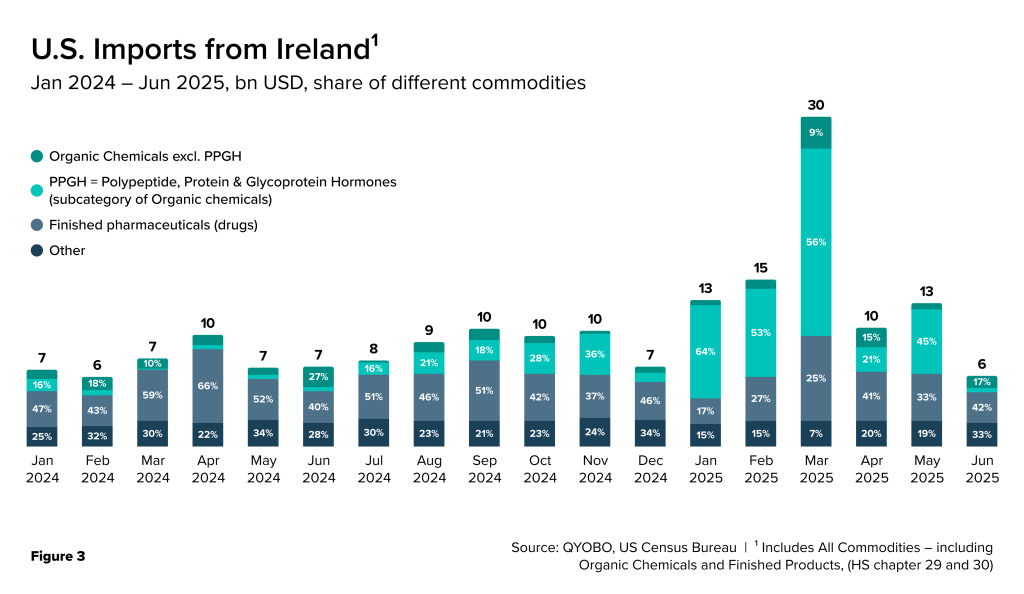

Recent U.S. import data (U.S. Census Bureau) covering January 2024 through June 2025 highlights Ireland’s disproportionate contribution in supplying both APIs and finished drug products. In the first half of 2025, import volumes showed pronounced fluctuations – peaking in March, easing in April, and partially rebounding in May (Figure 1, 2 & 3).

This surge aligns with President Trump’s Inaugural Address on January 20, 2025, where he first signaled new tariffs on foreign pharmaceuticals. The sharp March 2025 spike likely reflects companies front-loading shipments ahead of such measures. Later, on April 2, 2025 – “Liberation Day” – the administration formally imposed a 10% tariff on all imports while suspending reciprocal tariffs, giving countries a 90-day negotiation window (Ernst & Young Global Limited, April 11, 2025). Even though the pause, in effect from April 9, 2025, was set to expire on July 8, 2025, the administration extended it until August. The smaller rebound in May imports suggests additional stockpiling ahead of the original deadline.

Imports of organic chemicals into the U.S. spiked sharply in March 2025 amidst ongoing tariff uncertainties. $23 billion worth of organic chemicals entered the U.S. in March 2025 (Figure 2), $20 billion of which came from Ireland. This pattern indicates that pharmaceutical companies advanced shipments to the U.S. to secure supply ahead of potential trade measures.

The PPGH Surge: Unprecedented Growth

Much of the organic chemical import spike from Ireland was driven by “Polypeptide, Protein & Glycoprotein Hormones” (PPGH, HS code 293719), a category that includes APIs for GLP-1 drugs (Figure 3).

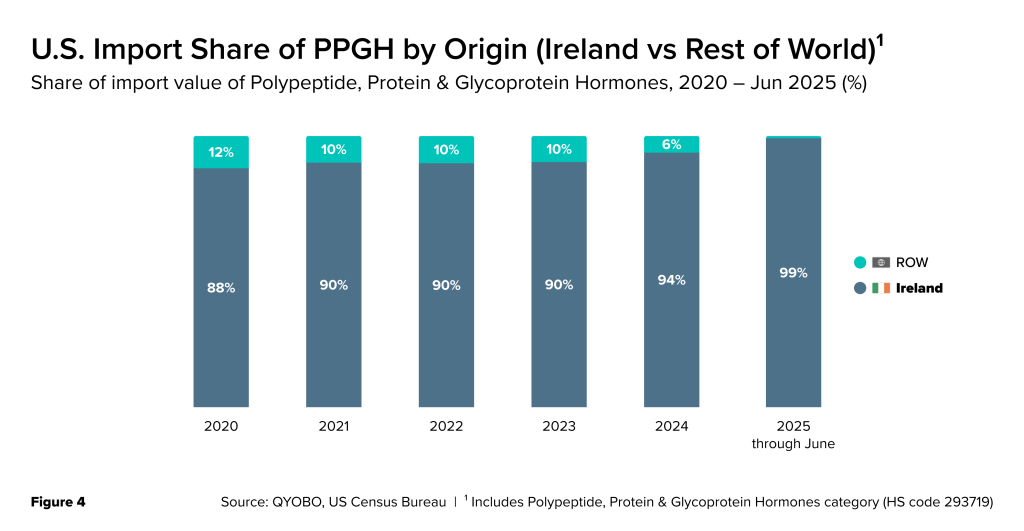

Over the past five years (Figure 4) , Ireland has been the primary supplier of PPGH to the U.S., accounting for an average of around 90% of the total import value (in USD billions) (Figure 4) . In H1 2025, U.S. Census data reflects this share climbed to an extraordinary 99%, effectively making Ireland the near-exclusive foreign source of these therapies for American patients.

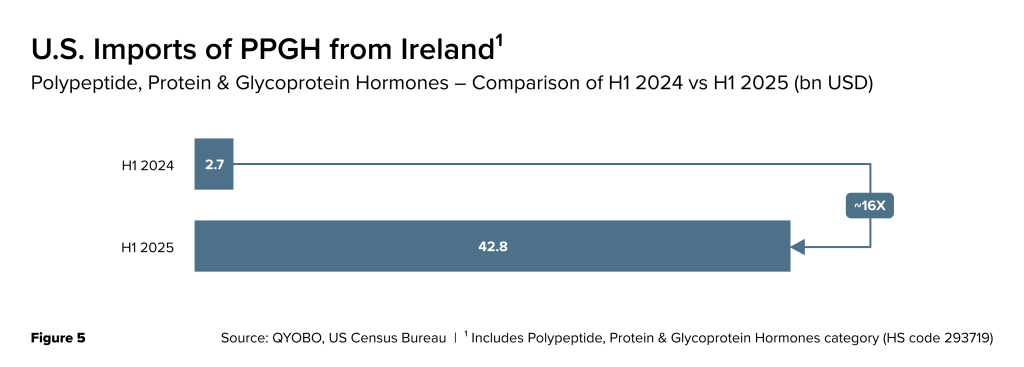

As per the same source (U.S. Census Bureau – USA Trade Online), the value of imports of PPGH from Ireland rose from $2.71 billion in H1 2024 to $42.81 billion in H1 2025 – a ~ 16X increase (Figure 5).

The United States is one of the largest and fastest-growing markets for GLP-1 drugs (Grand View Research, November 7, 2024), with demand accelerating due to their expanding use beyond diabetes into obesity treatment and potential cardiovascular applications. The surge further supports the idea that pharmaceutical companies accelerated imports in the United States in anticipation of potential trade disruptions (The Irish Times, March 18, 2025).

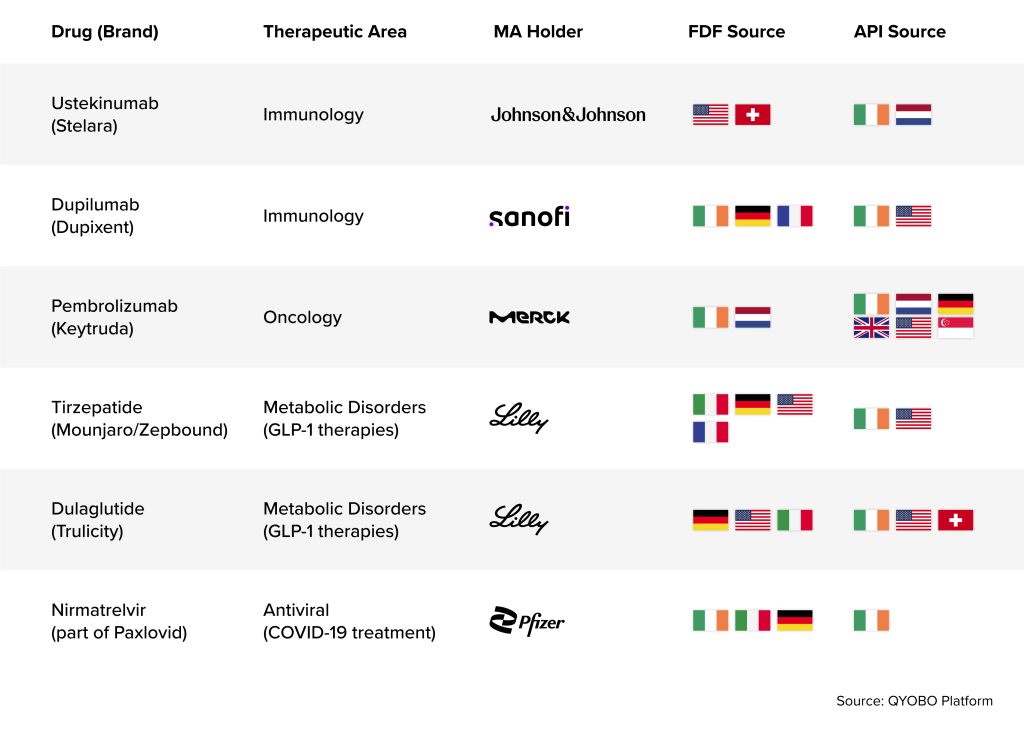

Blockbuster Drugs

Ireland’s strategic importance to pharmaceutical supply chains is reinforced by the presence of virtually every leading manufacturer in the country. Companies such as Pfizer, Merck & Co., Johnson & Johnson, Sanofi, and Eli Lilly all operate significant API and FDF production facilities across Ireland. As a result, a long list of blockbuster medications rely on Irish production sites.

Major blockbuster drugs, where Irish manufacturing sites contributing to U.S. pharmaceutical supply are:

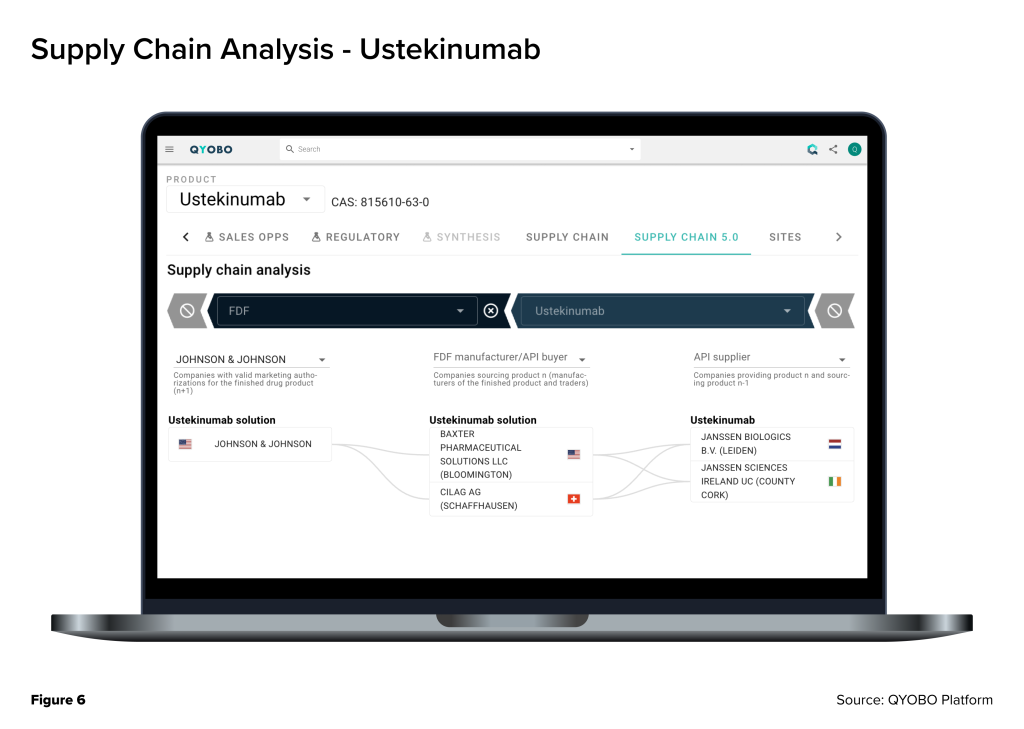

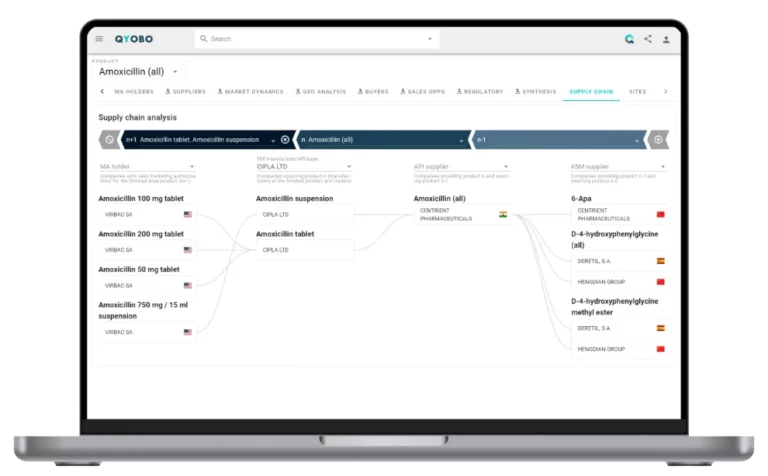

Tracking these supply chains in real time is possible through the QYOBO platform, which provides granular visibility into every step – from API manufacturing sites to FDF production and global distribution nodes. As shown in the attached supply chain analysis (Figure 6 & 7), QYOBO platform maps the manufacturing footprint, sourcing relationships, and site-level details that are critical for anticipating risks and ensuring continuity for these essential medicines.

Infrastructure Investment (2020-2025)

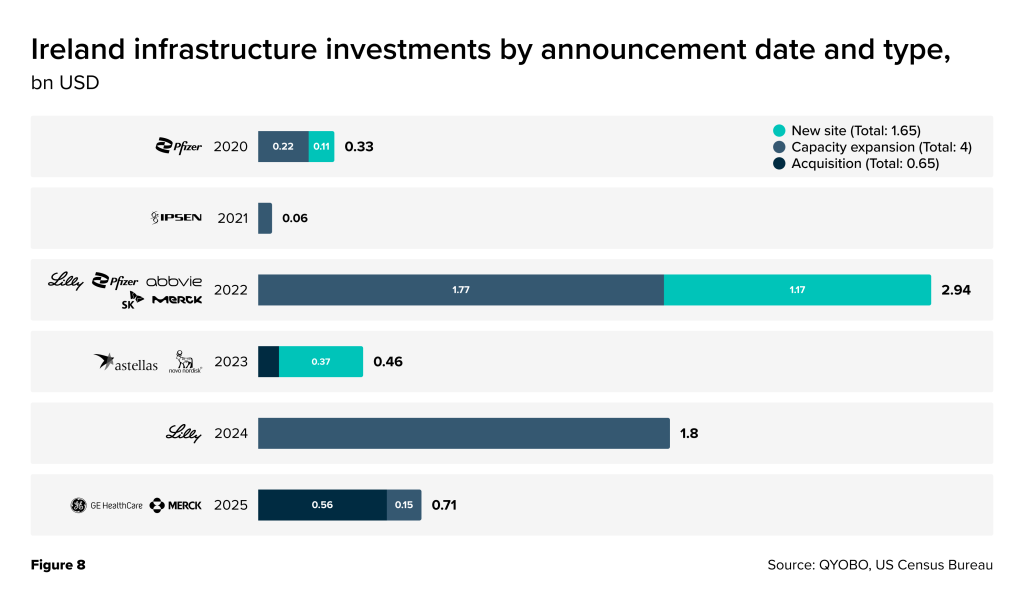

Ireland’s prominent role has been underpinned by an aggressive expansion of pharmaceutical manufacturing infrastructure in recent years. Since 2020, companies have announced a series of new facilities, plant expansions, and strategic acquisitions in Ireland, amounting to well over $6 billion in investment (Figure 8). This capital intensity reflects long-term commitments to Irish production: 2022 alone saw nearly $3 billion in announced projects (the largest single-year spike), including a large new Eli Lilly biologics plant (Eli Lilly Investor Relations, September 12, 2024) and major capacity expansions by other multinationals such as AbbVie (AbbVie Ireland Media Room, September 21, 2022) and SK Pharmteco (Pharmaceutical Commerce, June 15, 2022). In short, virtually every year since 2020 has featured significant capacity-building by pharma companies in Ireland, cementing the country’s status as a global manufacturing hub.

In H1 2025, months before the official August announcement but amid growing expectations of new U.S. tariffs on pharmaceuticals, some companies began diversifying their production footprint. In April 2025, AbbVie announced that it would invest $10 billion over the next decade in four new U.S. production facilities for APIs, biologics, peptides, and medical devices (Fierce Pharma, April 25, 2025). Merck & Co., in the same month, committed $1 billion to build its first U.S. facility to produce Keytruda, its blockbuster cancer therapy, after previously manufacturing it overseas (Reuters, April 29, 2025). These moves, explicitly linked to preparing for possible sector-specific tariffs, reflect a broader shift from a purely global model toward more local capacity, as firms adapt to a trade environment where policy changes can disrupt supply overnight, highlighting the fragility of a once-stable pharmaceutical supply chain.

Conclusion: Tariff Turbulence and Its Broader Impact

As of August 2025, the U.S. has imposed a 15% tariff on pharmaceutical imports from the EU, directly hitting Ireland. For Ireland, this means exports become instantly more expensive, threatening its competitive edge and potentially slowing shipments. The H1 2025 surge in imports can be viewed as precautionary build-up of supply as companies are now mindful of lessons from the COVID-19 supply shocks. Longer term, sustained duties could push companies to shift some production to the U.S. or other regions.

For the U.S., the tariff risks raising costs for medicines heavily sourced from Ireland, from cancer drugs to GLP-1 therapies, unless companies absorb the hit. In some cases, reduced shipments could increase shortage risks. While this could accelerate plans to boost domestic manufacturing, such capacity, especially for complex biologics, takes years to build. The result is higher costs and greater uncertainty in a supply chain that has long been seamless.

Historically, pharmaceutical products were exempt from import tariffs, reflecting a global consensus to safeguard medicine supply chains. The new 15% U.S. duty marks a decisive break from that norm. As trade frictions reshape costs and sourcing strategies, the ability to track, analyze, and secure supply lines has never been more vital. QYOBO platform supports pharmaceutical companies by providing real-time visibility into API and FDF flows, along with early alerts on disruptions from Ireland and other key markets.