How Tariff Uncertainty Is Reshaping U.S. Pharma Supply Chains

Rapid shifts in tariff policy have shaped the past weeks. While the pharmaceutical industry is largely spared from tariffs for now (sources: Yahoo Finance, April 3, 2025; Bloomberg, April 2, 2025; Fierce Pharma, April 2, 2025), the Trump administration launched an investigation into pharmaceutical imports under the national security-focused Section 232 on April 1st, setting the stage for potential tariffs on finished drugs and active pharmaceutical ingredients (APIs), to encourage more U.S.-based production (WSJ, April 14, 2025). On May 5, 2025, President Trump told reporters that he plans to unveil pharmaceutical-specific tariffs within the next two weeks (CNBC, May 5, 2025).

QYOBO’s Tariff Tracker

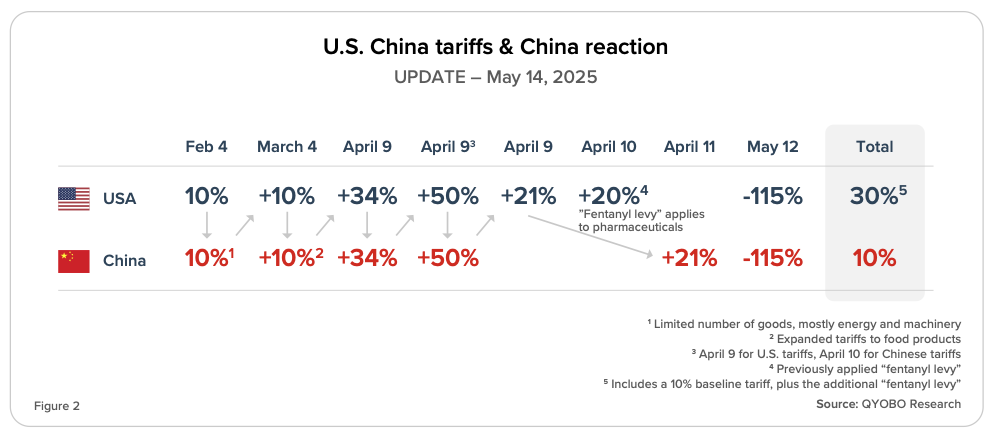

The high reciprocal “Liberation Day” tariff rates have been paused and replaced with a 10% baseline tariff for all countries (Figure 1). U.S. tariffs on Chinese imports had surged to 145% since Liberation Day (Figure 2), while China had raised duties on U.S. goods to 125% (CNBC, April 9, 2025). On May 12, the U.S. and China agreed to a 90-day suspension of most tariffs, jointly reducing reciprocal tariffs from 125% to 10% (CNBC, May 12, 2025). The U.S. will maintain its 20% “fentanyl levy,” which also applies to pharmaceutical imports, resulting in an effective 30% tariff on Chinese goods (CNBC, May 12, 2025; CNBC, April 12, 2025) (Figures 1 & 2).

Tariffs on Chinese pharmaceutical imports are especially concerning for the pharmaceutical sector, which remains heavily dependent on Chinese manufacturing. An analysis conducted via the QYOBO platform reveals that 87% of drugs sold on the U.S. market rely on Chinese starting materials. While the degree of dependency varies slightly by therapeutic area — antibacterials and analgesics at 84%, oncologics at 86% — the overall reliance remains consistently high and difficult to replace in the short term.

Industry Responses

Although largely shielded from direct tariffs, the pharmaceutical sector faces pressure from potential new tariffs and proposed drug pricing reforms like the “most-favored-nation” model. As of May 13, the S&P 500 Health Care Sector Index is down over 4% year-to-date (S&P Global), while the S&P 500 Pharmaceuticals Industry Index has fallen more than 7% (MarketWatch), despite stronger-than-expected Q1 profits from companies like Merck & Co. (Reuters, April 24, 2025). Meanwhile, the broader S&P 500 rose on Tuesday, turning positive for 2025 with a 0.1% gain after rebounding from an earlier 17% decline amid U.S.-China trade tensions (CNBC, May 13, 2025) .

Merck & Co. exemplifies how these macroeconomic headwinds are translating into company-specific cost pressures and strategic shifts. The company anticipates an additional $200 million in costs this year due to existing U.S. tariffs, including a 10% import tax and retaliatory measures from countries like China (The Guardian, April 24, 2025). This does not yet account for potential “major” tariffs on pharmaceutical imports recently announced by the Trump administration (The Guardian, April 24, 2025). The company’s primary exposure centers on its flagship oncology treatment, Keytruda (Figure 3). The API for Keytruda (Pembrolizumab) supplied to the U.S. market is primarily manufactured in Germany by Boehringer Ingelheim, with additional capacity in Ireland (MSD/Merck & Co.) and the United States (AstraZeneca). The finished dosage form (FDF) is produced in Ireland by MSD/Merck & Co. While Merck has stated it has sufficient U.S. inventory for this year (Reuters, April 24, 2025), the company is actively expanding its domestic manufacturing footprint. On April 29, 2025, Merck & Co. broke ground on a new $1 billion biologics facility in Delaware, designed to be the future U.S. manufacturing hub for Keytruda (Merck & Co., April 29, 2025).

Several originator companies have already announced investments into new or existing U.S. facilities (see also our previous previous blogpost on tariffs), with Roche pledging $50 billion over the next five years (Reuters, April 22, 2025). Yet uncertainty surrounding the proposed pharmaceutical tariffs is deterring companies like Pfizer from further investing in U.S. manufacturing and R&D, as CEO Albert Bourla noted during the company’s first-quarter earnings call on April 29, 2025 (CNBC, April 29, 2025). The industry’s efforts to expand domestic manufacturing could also face obstacles, as the Trump administration moves to dismiss FDA staff responsible for critical inspections of new drug manufacturing sites (Reuters, April 24, 2025). Meanwhile, on May 5, 2025, President Trump signed an executive order directing the FDA to fast-track domestic drug manufacturing approvals through streamlined reviews and regulatory simplification (CNBC, May 5, 2025).

Substances Currently not Excluded from Tariffs

According to the fine print of the executive order, pharmaceuticals (finished drugs) and many, but not all, raw materials are largely exempt from current tariffs. APIs) that remain subject to tariffs include:

- Ibuprofen (previously highlighted in our last newsletter and on LinkedIn)

- Magaldrate

- Sodium salicylate

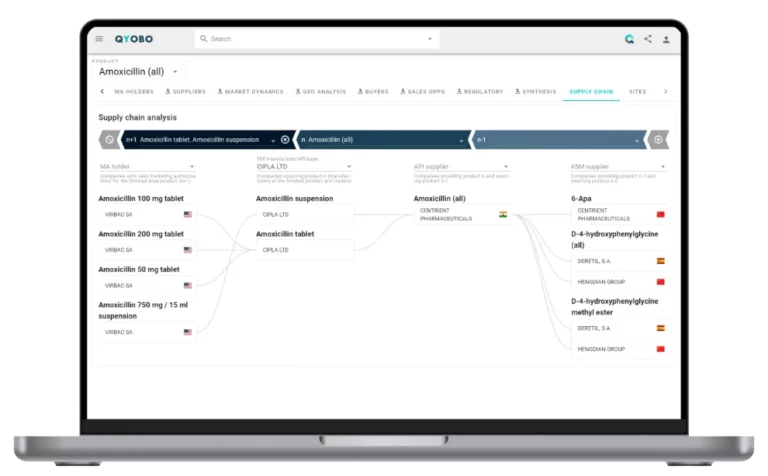

Tariffs on these APIs have direct implications for U.S.-based finished dosage form (FDF) manufacturers that rely on foreign suppliers. U.S.-based manufacturers of Ibuprofen FDFs like Ascent (a subsidiary of Hetero Drugs) could face additional costs, as they primarily source their active ingredients from overseas suppliers (Figure 4).

There is a larger list of key starting materials (KSM) and excipients that are currently not excluded. Glycerol, for example, is widely used as an excipient and solvent in cremes, ointments, gels, and syrups due to its moisturizing and stabilizing properties.

The following U.S. FDA manufacturing sites rely on now-tariffed KSMs:

- Ampac Fine Chemicals

Imports 2,2-Difluoropropionic acid, ethylbenzene, BF₃ acetic acid, and R-propylene carbonate from India. - Polypeptide Group

Operates two U.S. sites that import ethyl cyanohydroxyiminoacetate from China. - Cambrex and Curia

Import N-hydroxysuccinimide from China.

For more information on which materials are currently not excluded from tariffs, feel free to reach out.

Company Manufacturing Footprint

The QYOBO platform offers comprehensive insights into the global manufacturing footprint of pharmaceutical companies, detailing site locations, operational roles, and compliance status, consolidated from over 19,000 regulatory filings.

Eli Lilly’s manufacturing network spans a global footprint, with facilities in Spain, France, Italy, Ireland, China, and the United States (Figure 5).

Eli Lilly is actively expanding its capacity through major investments:

- Alzey, Germany (Lilly Investors, November 17, 2023)

Focus: New manufacturing site for injectables for Diabetes and obesity medication.

Investment: $2.5 billion

Jobs: ~1,000

Operational by 2027 - Kobe, Japan (Pharma Japan, September 28, 2023; Bloomberg, June 6, 2024)

Focus: New manufacturing building at Seishin plant, Kobe. Focus on Mounjaro.

Investment: $45 million

Operational by 2025 - Limerick, Ireland (Lilly investors, September 12, 2024)

Focus: New biologics manufacturing facility.

Investment: ~$2 billion

Jobs: ~450

Operational by 2026 - Kenosha, Wisconsin (Lilly Investors, December 5, 2024)

Focus: Expansion of a recently Nexus-acquired facility with a focus on injectables for diabetes and obesity medicines.

Investment: ~$3 billion

Jobs: ~750 - Lebanon, Indiana (Lilly investors, May 24, 2024)

Focus: New API manufacturing facility for Tirzepatide

Investment: ~$9 billion

Jobs: 900

Operational by 2026 - Research Triangle Park, Durham (Lilly Investors, January 24, 2023)

Focus: Site expansion for GLP1 medicines.

Investment: $450 million

Jobs: 100 - Suzhou, China (Fierce Pharma, October 11, 2024)

Focus: Site expansion for diabetes and obesity medicines.

Investment: ~$200 million

Jobs: ~120

Eli Lilly’s GLP-1 API production is concentrated in Kinsale (Ireland), Branchburg (US), and Indianapolis (US) (Figures 6 & 7). In addition, Eli Lilly partners with Corden Pharma (US), a full-service CDMO, for contract manufacturing of Tirzepatide API for the U.S. market.

Navigating Tariff Uncertainty with QYOBO

With tariff policies evolving rapidly, staying prepared is crucial. QYOBO helps pharmaceutical companies manage this uncertainty by pinpointing tariff exposure and highlighting where rising input costs or new opportunities may emerge. Our platform quantifies these shifts across your product portfolio based on global supply chain data.