U.S. Pharmaceutical Supply in the Context of Recent Tariff Plans

The U.S. has imposed a 20% tariff on pharmaceutical imports from China, with broader tariffs on major trade partners like the EU and India expected soon. This poses significant risks to U.S. drug supply security and pricing, especially for generics manufacturers operating on tight margins. While some originator companies are expanding domestic production, structural challenges and policy uncertainty hinder broader reshoring efforts.

Introduction

The U.S. government’s 2025 tariff policy marks a major shift by introducing a 20% tariff on pharmaceuticals imported from China, products that were previously exempt under the WTO Pharmaceutical Agreement. Additional tariffs targeting imports from the EU and India are under consideration as of April 2025.

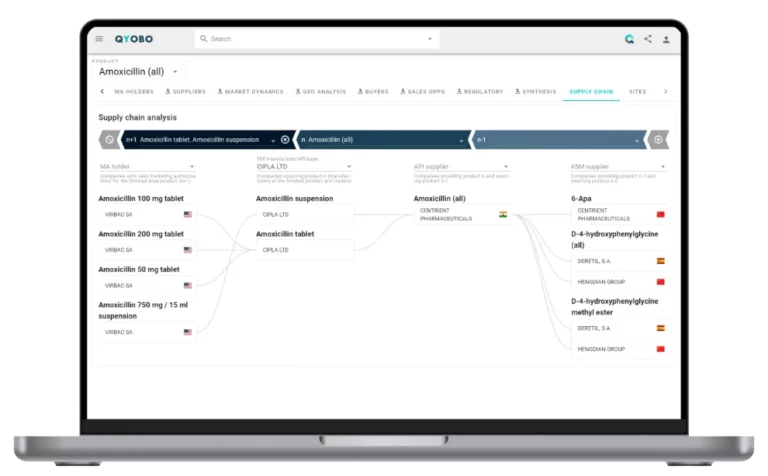

QYOBO is closely tracking these developments. Leveraging data from the QYOBO platform, we analyze the potential implications of the new tariff regime on U.S. pharmaceutical supply security, global supply chain dynamics, and strategic risks and opportunities for pharmaceutical companies.

Tariffs could lead to higher drug prices, supply disruptions, and manufacturing shifts. However, generics manufacturers may face greater challenges adapting due to cost constraints and limited margins.

QYOBO’s Tariff Tracker

As of March 4, a 20% tariff applies to all pharmaceutical products imported from China. While tariffs of 25% on imports from Mexico and Canada were initially planned, they have been paused for goods that meet the USMCA rule of origin.

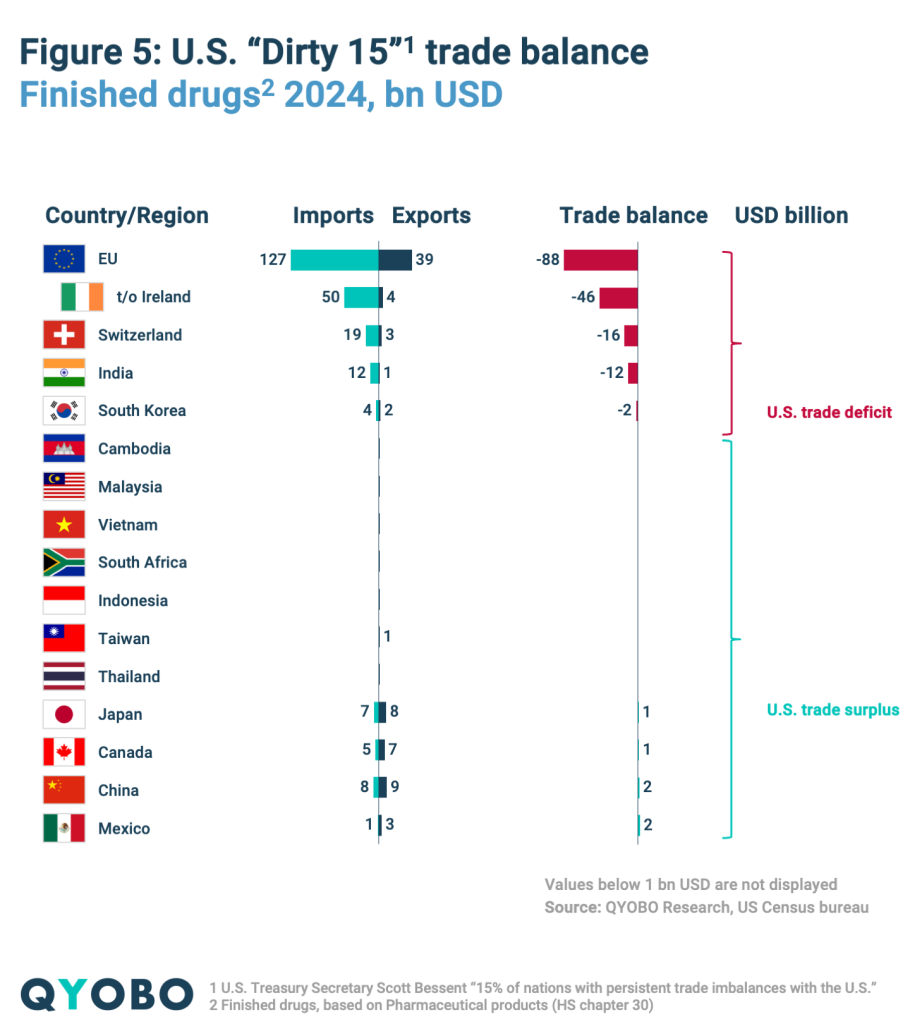

A new wave of tariffs is expected to be announced by April 2, targeting the so-called “Dirty 15.” Although the full list has not been released, the countries with the largest U.S. trade deficits will presumably be included. The EU, India, and Japan are widely expected to be affected, given the scale of their trade surpluses with the U.S. (Wall Street Journal, 2025; Fortune, 2025) An overview of current and expected tariffs is visualized in the QYOBO Tariff Tracker (Figure 1).

U.S. Pharmaceutical Trade Balance and Key Suppliers

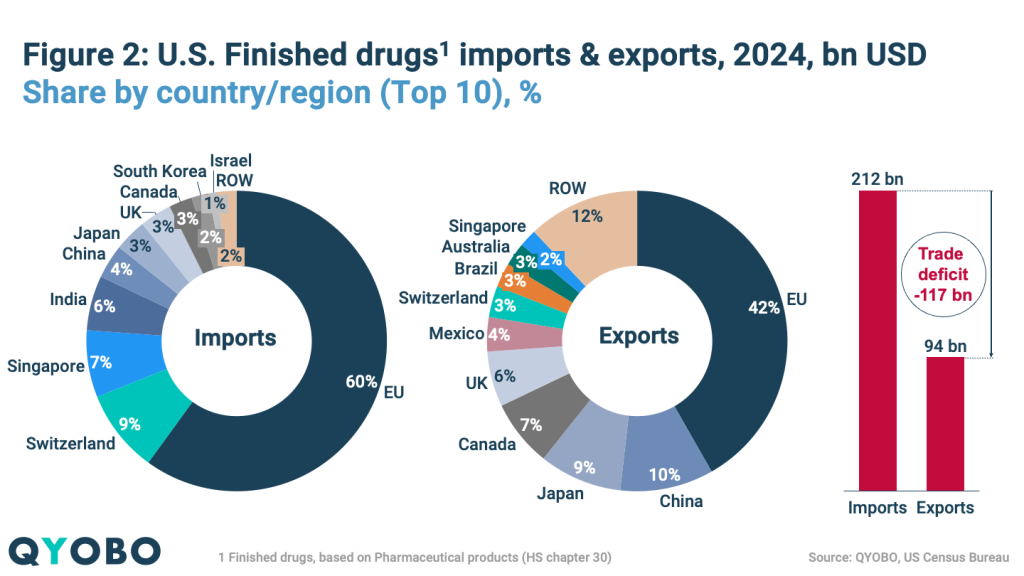

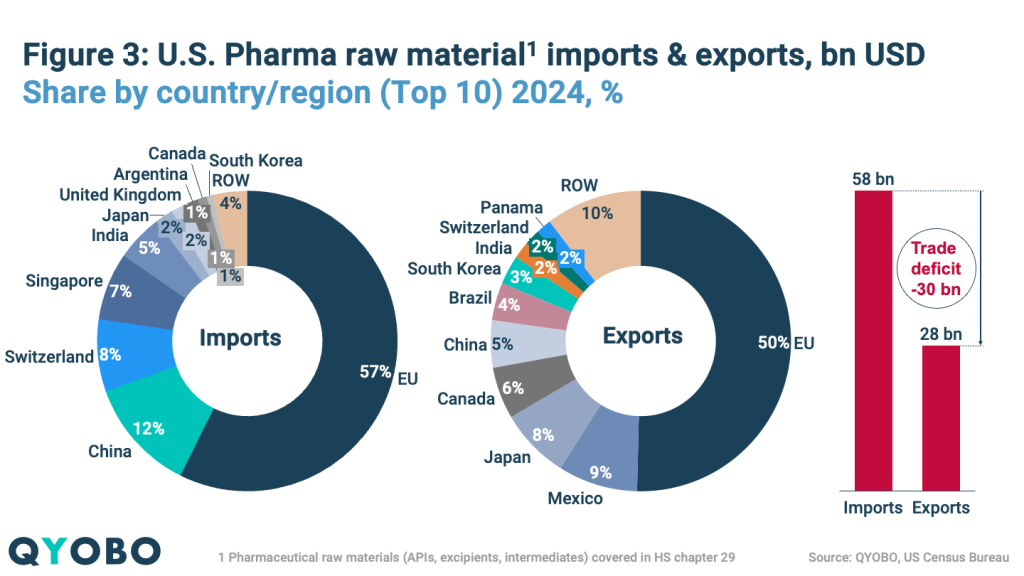

The U.S. pharmaceutical market remains highly dependent on imports for both finished medicines and raw materials. In 2024 (Figures 2 and 3):

- Finished pharmaceutical imports totaled $212 billion, with the EU accounting for 60%, followed by Switzerland (9%), Singapore (7%), India (6%), and China (4%)

- Pharmaceutical raw material imports reached $58 billion, led by the EU (57%), with China (12%), Switzerland (8%), Singapore (7%), and India (5%) following

On the export side (Figures 2 and 3):

- The U.S. exported $94 billion in finished pharmaceuticals, primarily to the EU (42%), China (10%), Japan (9%), Canada (7%), and the UK (6%)

- Pharmaceutical raw material exports totaled $28 billion, with top destinations being the EU (50%), Mexico (9%), Japan (8%), Canada (6%), and China (5%)

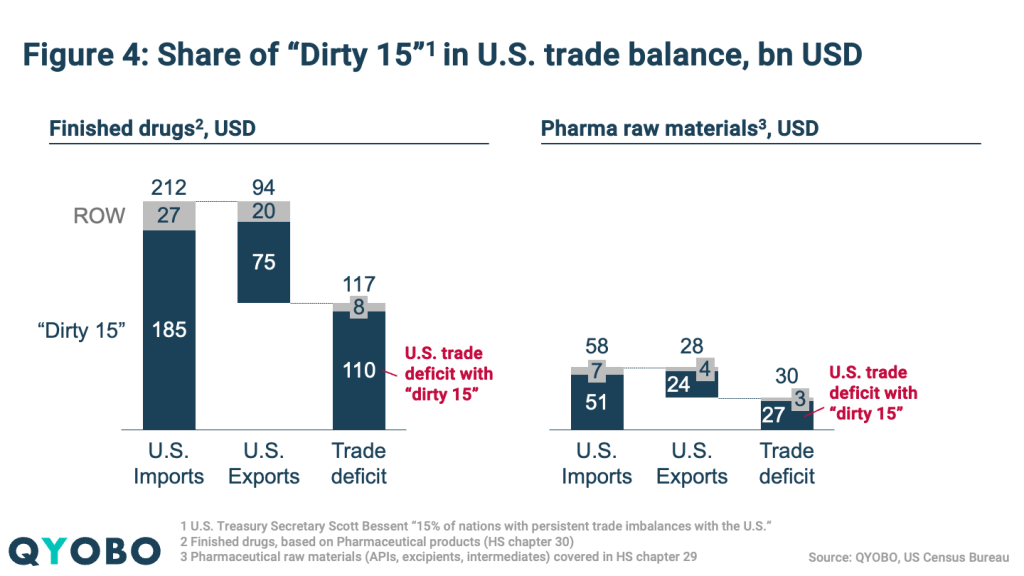

The “Dirty 15” – presumably countries with the largest U.S. trade deficits – account for (Figure 4):

- 87% of total U.S. finished drugs import value and 79% of export value

- 88% of U.S. raw material imports and 86% of exports

This illustrates the substantial exposure of U.S. pharma trade to upcoming tariff measures.

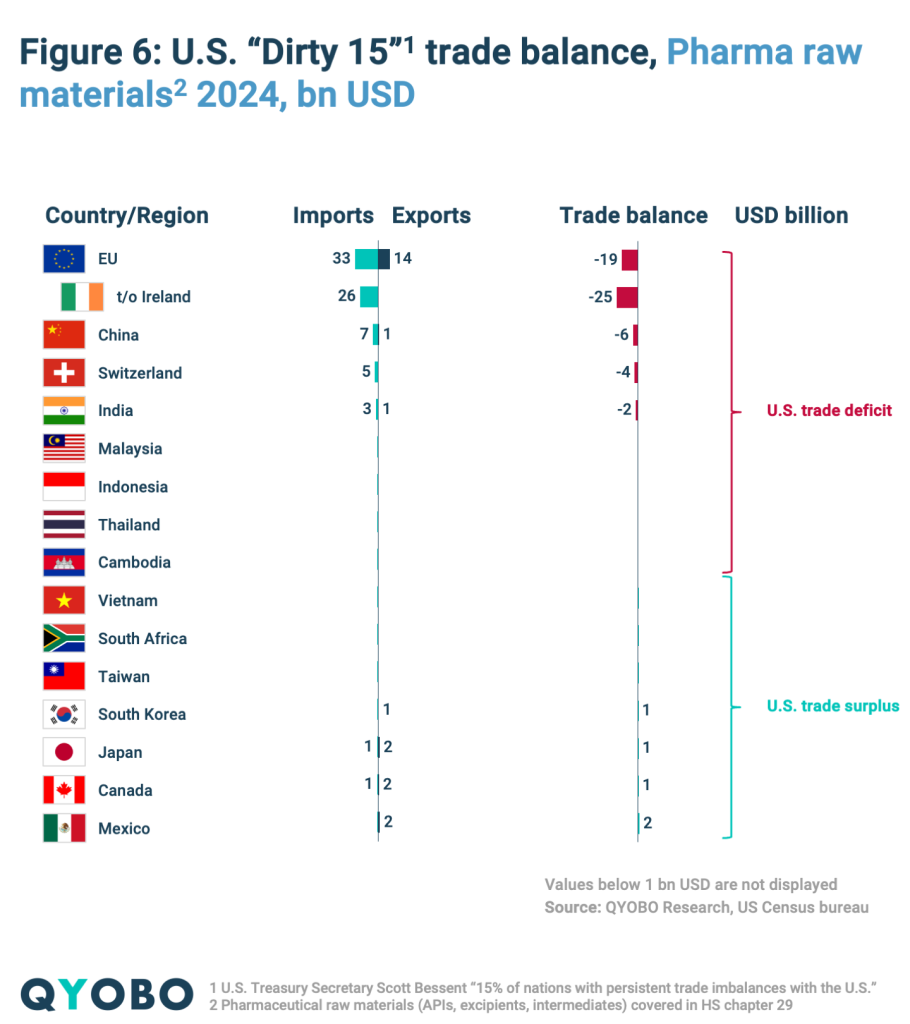

The U.S. recorded significant trade deficits in 2024 (Figure 4):

- $117 billion for finished pharmaceuticals

- $30 billion for raw materials

The largest deficit is with the EU, especially Ireland, which holds the highest trade surplus with the U.S (Figure 5 and 6). With China, the U.S. had a $1.7 billion surplus in finished drugs but a $5,6 billion deficit in raw materials. In contrast, the U.S. maintains a trade surplus in both categories with Canada, Mexico, and Taiwan (Figure 5 and 6).

U.S. Market Exposure of Key Companies

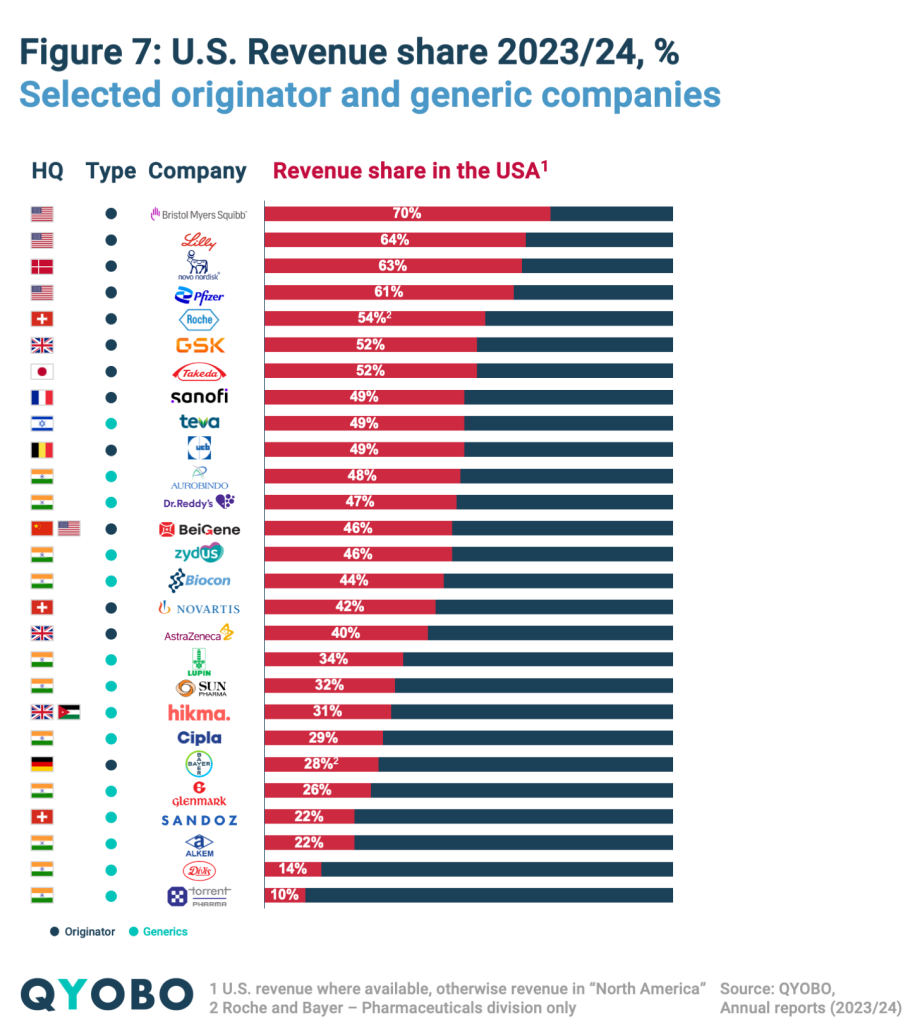

Many leading pharmaceutical companies rely heavily on the U.S. market (Figure 7). Among originators, Bristol Myers Squibb (70%), Eli Lilly (64%), Novo Nordisk (63%), and Pfizer (61%) generate the largest share of their revenues from the U.S., while AstraZeneca (40%), Hikma (31%), and Bayer (28%) have a lower reliance.

In the generics sector, companies such as Teva (49%), Aurobindo (48%), Dr. Reddy’s (47%), and Zydus (46%) derive a significant portion of their revenues from the U.S., whereas Divi’s (14%) and Torrent (10%) have a more limited presence in the market.

However, the impact of tariffs depends on a company’s manufacturing footprint – insights the QYOBO platform provides through its comprehensive supply chain intelligence.

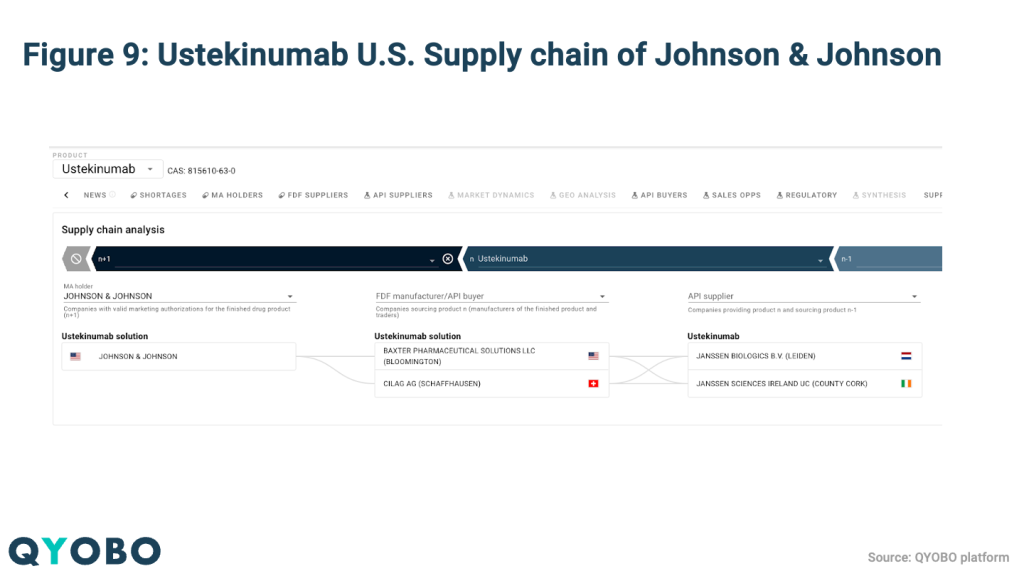

Johnson & Johnson, for example, maintains production sites across the EU, Switzerland, Israel, Puerto Rico, and the U.S (Figure 8). In the case of Ustekinumab, the company’s reliance on European manufacturing facilities places the product at high risk of tariff-related cost increases (Figure 9).

Industry Response

The prospect of U.S. tariffs on imported pharmaceuticals has revived discussions about reshoring drug manufacturing. While some originator companies are expanding domestic production, generics manufacturers so far have little incentive to invest in U.S. facilities. Much will depend on whether the tariffs are temporary or signal a long-term policy shift, something that remains uncertain for now.

Some companies are investing in U.S. manufacturing, while others are optimizing existing capacity:

- Pfizer CEO Albert Bourla highlighted the company’s ability to shift production domestically, stating, “We have 13 manufacturing sites in the US … if something happens, we will try to mitigate by transferring from manufacturing sites outside, to manufacturing sites here, the things that can be transferred quickly.” (Business Insider, 2025)

- Eli Lilly plans to more than double its U.S. manufacturing investment since 2020, exceeding $50 billion across four new facilities. (Lilly Investor Relations, 2025)

- Johnson & Johnson announced to increase U.S. investment to $55 billion including four new manufacturing sites. (Johnson & Johnson, 2025)

- Novo Nordisk is investing $4.1 billion in a new facility in North Carolina, doubling its U.S. manufacturing footprint. CEO Lars Fruergaard Jørgensen acknowledged their “relatively robust setup,” but emphasized that Novo is not “immune” to tariffs. “We still have products moving across borders like most global companies,” he said, noting that “there’ll be some short-term impact as we mitigate the impact of tariffs.” (Bloomberg, March 2025)

Generic firms like Sandoz expressed that the U.S. is not currently an appealing environment to make large-scale, long-term capital investments, especially those that take years to deliver. Sandoz CEO Richard Saynor pointed to deeper structural issues in the generics market: “There’s little point in investing in increased manufacturing… unless there are fundamental changes to how drugs are purchased.” (Bloomberg, March 2025)

United States-Mexico-Canada Agreement (USMCA) Exemptions

Under current USMCA Rules of Origin (USMCA, Rules of Origin), Canadian and Mexican pharmaceutical manufacturers can import Chinese APIs tariff-free and process them into finished drugs, qualifying these products as North American. In contrast, U.S. manufacturers importing the same Chinese APIs directly face a 20% tariff imposed during the Trump administration. As a result, these U.S. tariffs on Chinese imports have effectively placed domestic pharmaceutical manufacturers at a competitive disadvantage for the time being.

Impact on Drug Availability and Pricing

The pharmaceutical supply chain is already under pressure from persistent drug shortages and pricing challenges, particularly in the generics market. New tariffs introduce further uncertainty. As Novo Nordisk CEO Lars Fruergaard Jørgensen cautioned, “If you put tariffs on [generic medicines], I have a hard time seeing that that is not going to lead to other shortages of medicine or increased pricing in general.”(Bloomberg, March 2025)

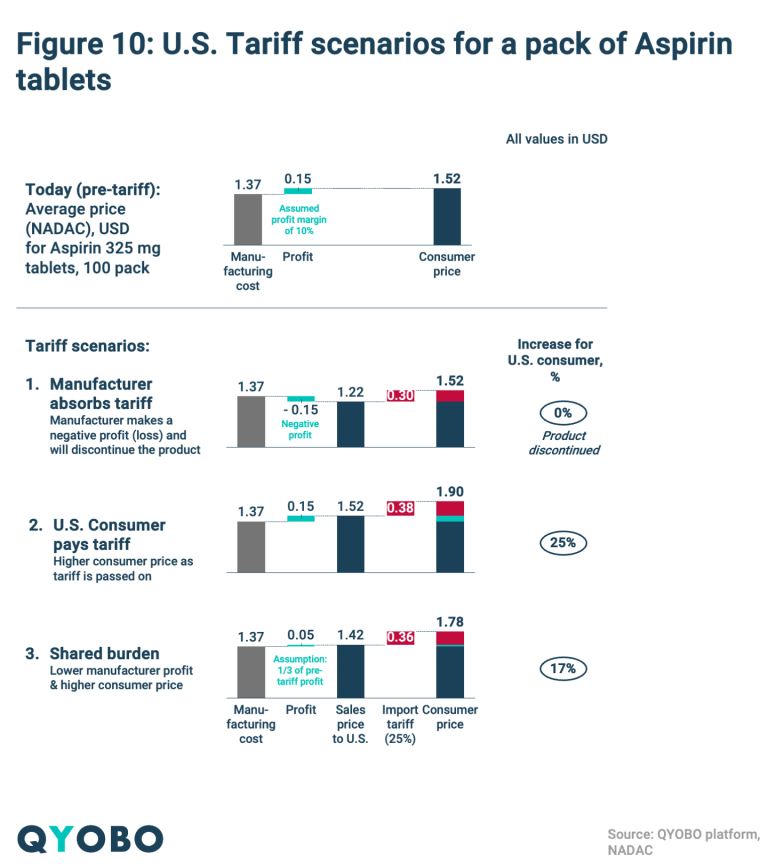

Companies affected by higher import tariffs are likely to pass increased costs on to consumers and payers, resulting in rising drug prices across the board. For generics manufacturers, who operate on especially thin margins, a 25% tariff may render certain products unprofitable (Figure 10). This could lead to supply disruptions if manufacturers choose to discontinue affected products. In markets with a concentrated supplier base, such withdrawals heighten both pricing pressure and the risk of shortages.

Adjusting supply chains takes time, even as reports suggest U.S. regulators may streamline approvals for domestic production. (Handelsblatt, 2025) Qualification of a new supplier typically takes 12 to 18 months, meaning supply disruptions could extend into the medium term.

Conclusion and Key Takeaways

- The U.S. has introduced a 20% tariff on pharmaceutical imports from China, with additional tariffs expected on April 2 for the so-called “Dirty 15”, likely including countries with the largest U.S. trade deficits such as the EU and India

- U.S. pharmaceutical imports rely heavily on countries subject to current or potential tariffs, particularly the EU, China and India

- Few originator companies, such as Novo Nordisk and Johnson & Johnson, have announced significant U.S. manufacturing investments, while generics manufacturer Sandoz remains reluctant to invest amid uncertainty

- USMCA tariff exemptions allow Canadian and Mexican FDF manufacturers to avoid tariffs on Chinese APIs, giving them an advantage over U.S. manufacturers

- Higher drug prices and potential supply shortages are likely, especially in the generics market where tariffs cannot be as easily absorbed compared to high-margin originator products